Creating Silver Linings through M&A During a Downturn: Part Two

The Opportunity to Refocus & Divest

The last U.S. recession is twelve-years in our rearview mirror, leaving modern data and anecdotes in its wake. Some companies were better prepared than others, creating more valuable cost structures, maintaining steady revenue or successfully mitigating any steep cliffs. These companies didn’t undertake extreme cost-cutting measures and chose not to lay off valuable talent, so when the economy stabilized, they were able to achieve strong growth in the new economic landscape. What did these successful businesses do differently than their peers? According to recent studies published by Forbes and Bain & Company, over 4,000 publicly-traded companies identified three major factors outlining that difference:

- Improving balance sheets through a combination of early cost restructuring and financial discipline;

- Selectively reinvesting in commercial growth through next-generation product and process R&D investments (i.e. customer experience and digital capabilities); and

- Being smart with M&A activity—both in divesting non-core businesses and acquiring strategic add-ons, including privately-held businesses, private equity platforms or another company’s divestiture.

In this article, Carleton McKenna will dive further into the 3rd bullet point, and discuss what silver linings may exist when a company divests a non-core business during an economic downturn.

Using divestitures as a means to advance corporate strategy.

Shedding non-core operations has the potential to unburden management time and focus as well as energize the core business, but only when such a carve-out is done with strategic intent and not simply for financial survival. Historically, during challenging economic conditions companies used divestitures as a means of reinforcing balance sheets, raising capital and improving financial positions.

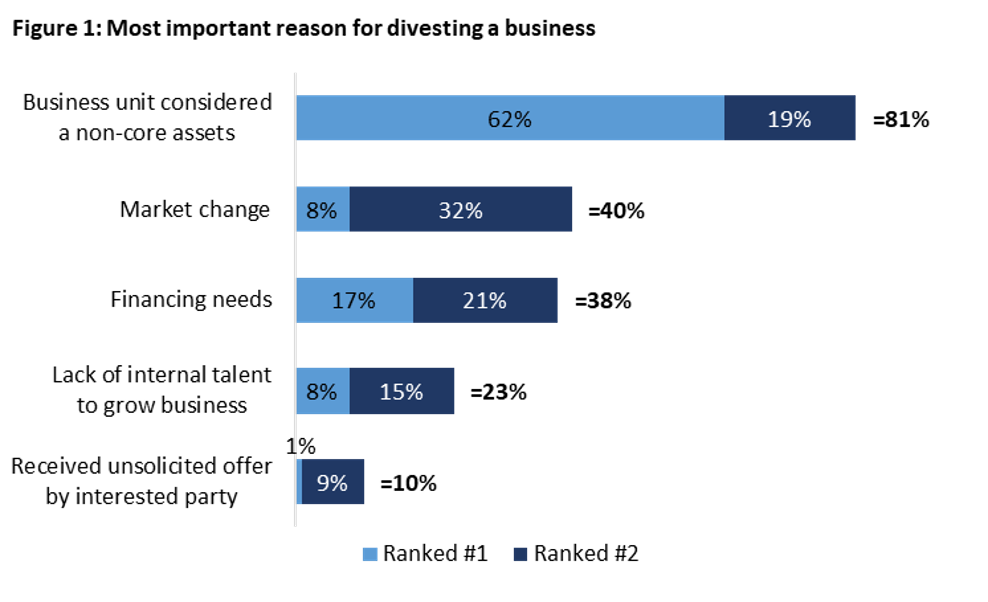

While these are still common considerations for executives — after the 2009 recession, 38% said “financing needs” was one of the top two most important reasons to divest — companies also use divestitures as part of strategic simplification (see Figure 1 for survey details). Investors and owners alike should proactively assess their portfolios and business units (whether facing the risk of an economic downturn or not) and determine if a near-term divestiture enhances their business strategy, and with it, has the potential boost their capital position. Connecting growth strategy to portfolio management creates a feedback loop that can allow a company to (i) adjust for various scenarios, both at the economic and corporate level, and (ii) reduce the need for reactionary moves that often result in strategic misalignment and value leakage.

Research shows strong positive market reaction to small divestitures in recessionary times.

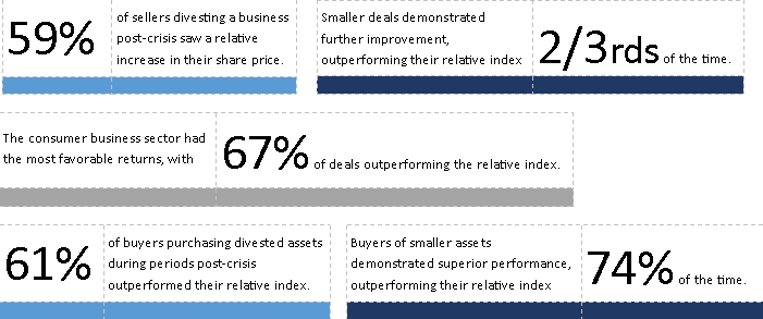

Inaction can be the riskiest response to economic uncertainties—while, strategically-focused and proactive action is key. According to a post-recession analysis by Deloitte, the post-crisis market generally rewards strategic divestments by companies that are able to clearly outline their future growth plans and hold an ambitious, but realistic strategy. Deloitte’s analysis also shows that buyers and sellers of smaller (under $1 billion) well-planned divestments reaped the greatest reward in both the short and long-term. In times of asset volatility, smaller divestments (vs. one large blockbuster sale) give investors confidence that both the seller and buyer can execute without becoming over-leveraged or enduring a long and difficult integration period. The majority of non-financial services businesses outperform the market in the long-term after divesting a non-core asset following an economic crisis, with the consumer business sector demonstrating remarkably higher returns.

Seller preparation and the go-to-market strategy are key to increasing value.

Although strategic factors are considered the most important factors in successful divestitures, companies remain intent on achieving at least their desired transaction value. How can a company work to maximize this valuation, even during times of economic distress to find silver linings? Three key points include:

- Conduct proper pre-sale preparation by identifying transaction risks and potential issues that could derail the process. This includes creating a line-up of M&A advisors and identifying their roles (this includes the investment banking team as well as attorneys, accountants and wealth managers).

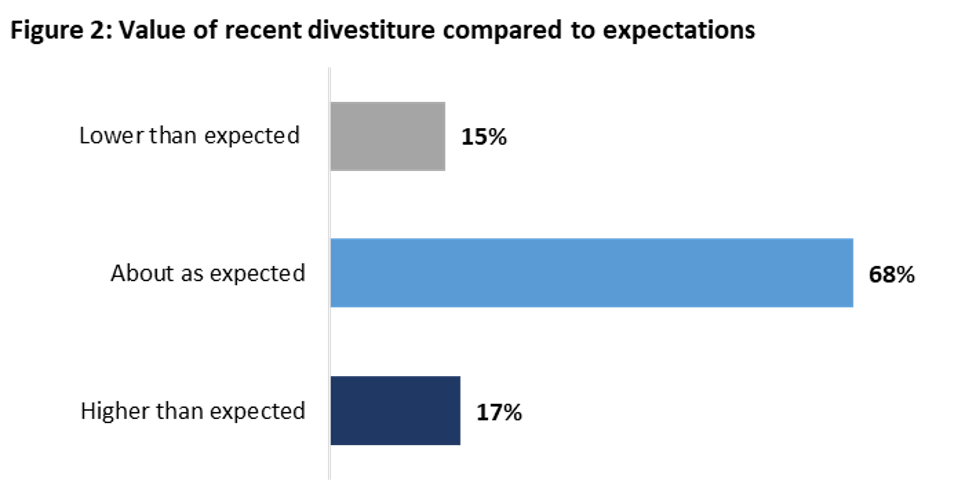

- Formalize a strategy behind buyer courtship and qualification. The most common reason selected in Deloitte’s survey for receiving a higher value than expected (see Figure 2) was multiple competing bidders. Although an exclusive sale to a single-bidder can be attractive in some cases, identifying multiple, qualified bidders increases the seller’s leverage for improved terms overall. With proper levels of financial and operational due diligence preparation, a well-run auction process can be even more timely due to the competitive nature of the process.

- Execute a smooth closing process. With an experienced M&A advisory team, the sale process should have a clear timeline with all parties working together to keep progress against milestones. A strong advisory team can help to reduce the time and stress associated with the negotiation of transaction documents (the primary reason that divestitures require more time than anticipated).

Understand Silver Linings: If a business unit is not critical and may increase vulnerability in recessionary times, now may be the time to divest.

Waiting for a better time to sell a non-core business with the hope of getting a higher price may not be the best answer, particularly as there is no assurance that a booming economy will return soon. Divestments can unlock substantial value for companies when properly assessed and done in alignment with long-term corporate strategy. If a business unit is not critical to your strategic priorities, they may distract and cause vulnerability in a recessionary period. Consider a divestiture now.

Sources: PwC, Forbes, Bain & Company, Deloitte, Harvard Business Review