Winter 2019/2020

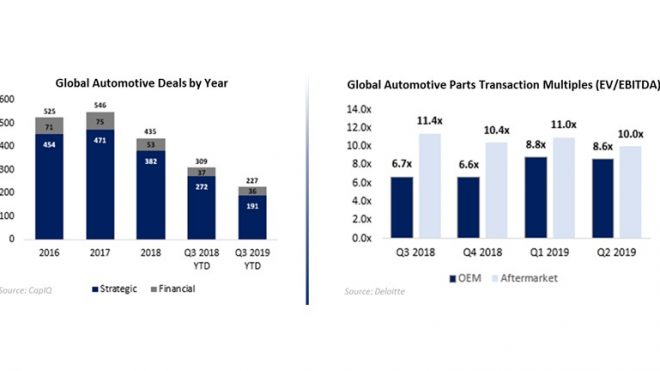

The current trade tension in China are expected to significantly impact the automotive industry both globally and domestically. This is directly reflected by a noticeable decline in transaction volume, dropping roughly 20% from 2017 to 2018 when tensions began to ramp up and 26% from Q3 2018 YTD to Q3 2019 YTD.

There was a noticeable spike in original equipment manufacturer (“OEM”) transaction value exiting 2018 into 2019, with multiples rising approximately 33% from Q4 to Q1. in wake of trade negotiations with China, financial and strategic buyers are willing to pay premiums on part manufacturers and suppliers, knowing that demand for more affordable parts will not teeter off to the same extent as overall sales should these negotiations turn south. This premium was also driven by increased interest in emerging markets like electrical vehicles and autonomous driving technology, with publicly traded OEMs placing a large focus in these areas.

Under current market conditions, several factors remain key in securing optimal valuations; including maintaining a strong and deep management team, implementing actionable growth strategies that mitigate product and customer concentration, and supplementation of attractive platforms like SUVs, pickups and crossovers.

Private Equity Interest in Automotive Parts

Financial buyers (typically private equity sponsors) are also active in the automotive parts industry. Although the majority if transactions are strategic buyers, financial buyers should not be overlooked in the M&A process. Across the U.S., private equity groups are looking to put meaningful capital to work and are aggressively seeking middle-market transactions.

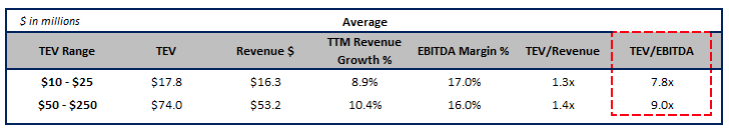

According to reported private equity transactions, financial buyers are willing to pay 7.0x to 9.0x EBITDA multiples for the right platform acquisition. Larger multiples are generally ascribed to larger transactions, typically over $50 million in Total Enterprise Value (“TEV”) with high potential for revenue growth.

Source: GF Data

Relevant Market Trends

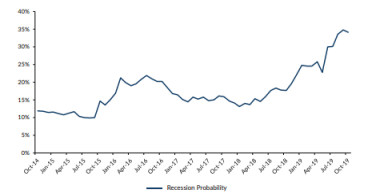

Reliance on the automotive industry as a whole introduces cyclicality risk within the industry. As of October 2019, economists surveyed by the Wall Street Journal indicate a 34% chance of recession within the next twelve months, up from the prior year’s 18% probability. Probability has also risen from 26% from the previous quarter. Reasons cited for concern include escalating trade tensions with China and the recent contraction of U.S. manufacturing activity evidenced by a decrease in the U.S. Manufacturing PMI since January 2019.

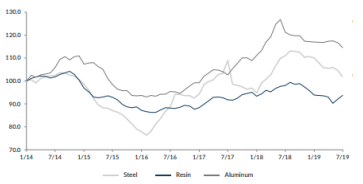

Raw material prices are continuing to hover near six-year highs, leaving OEMs to wrestle with cost volatility of steel, aluminum, copper, and plastics. The outlook for these materials remain uncertain because of ongoing trade tensions with China despite experiencing some relief since price indices peaked in July of 2018.

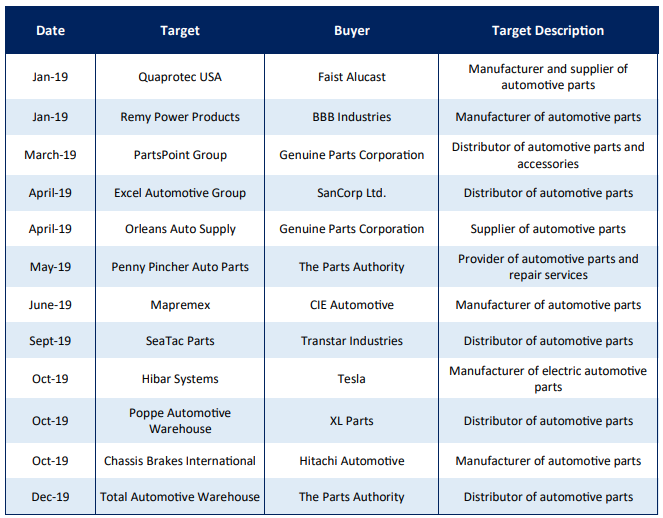

Select Automotive OEM and Aftermarket M&A Transactions

Source: Pitchbook, CapIQ, Deloitte

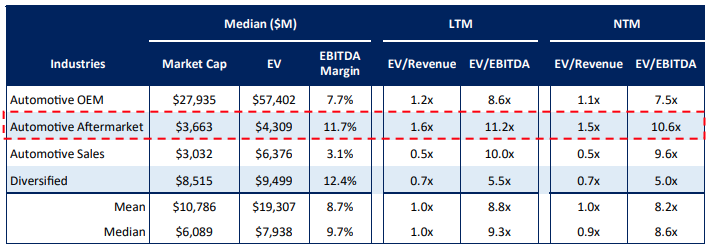

Public Comparable companies Trading Statistics by Sector - Q2 2019