The demonstrated surge of food and beverage transactions in 2021 continued unabated into 2022, aligning with broader transaction trends in private equity. Activity slowed in the second half, impacted by inflation, rising interest rates and a shakier geopolitical situation¹. Global private equity-backed deals for a wide variety of food and beverage businesses (restaurants, food retailers, packaged foods and meat businesses, and meat producers) totaled $9.69 billion through November of 2022; equivalent to ~18% of the 2021 full-year private equity total of $54.7 billion¹.

Despite the noted external pressures, strategic M&A interest remained strong through the second half of 2022 (see next page), demonstrating both the defensive nature and diversification-focused mindset within this industry, where growth by acquisition is often faster, less costly, and more predictable than organic growth².

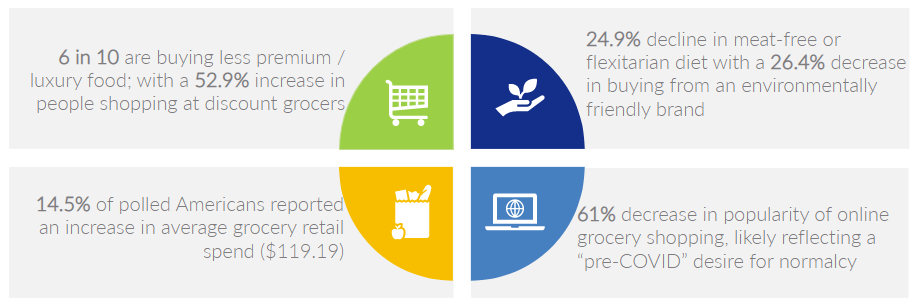

2022 Hot Topic: U.S. Food Inflation²

With more consumers looking for discounted options, private label food manufacturers and processors should continue to see an uptick.

The drive to discount will be offset somewhat by implementation of price increases through 2023, which are needed to mitigate rising costs and maintain margins. Acquirers have shifted efforts toward boosting sales volumes and maintaining normalized, sustainable margin levels³.

Rising borrowing costs for buyers through interest rate hikes will also constrain leverage availability, and in some cases, M&A valuations. However, the market still has plenty of excess capital sitting with private equity investors and strategic acquirors.

“The positive demand trends for private label are clear, and simplifying our business will position us to better capitalize on those trends to drive value now and well into the future,”

– Steve Oakland, CEO of Treehouse Foods, remarking on exiting their meal preparation business to focus on private labeling.

Plentiful funding will continue to drive demand for high-quality food and beverage acquisitions, and recent inflationary issues in the sector will allow some buyers to be opportunistic with targets experiencing challenges weathering the recent volatility³.

Sources: (1) S&P Global; (2) Food Institute; (3) Kroll

2022 Food & Beverage Transaction Highlights

Monster Energy acquired CANarchy on 02/17/22 for $330.0M. This acquisition allows Monster Energy to ender the beer and hard seltzer market through already in-place infrastructure, distribution and licenses possessed by CANarchy.

J&J Snacks Foods acquired Dippin’ Dots on 06/01/22 for $223.6M. This purchase will allow J&A Snack Foods to add a strong consumer brand with a profitable, growing business that it can scale further in the near future.

Mondeléz International acquired Clif Bar & Company on 08/01/22 for $2.6B. This acquisition of the bar maker includes Clif, Luna and Clif Kid brands and will expand Mondeléz’s global snack bar business to more than $1B.

Nestlé acquired Seattle’s Best Coffee brand from Starbuck’s on 10/19/22 for $7.1B. Nestlé already had a large presence in the coffee industry, and with this acquisition, they will be able to double the size of their presence.