2021 Overview

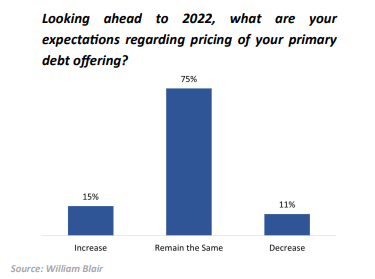

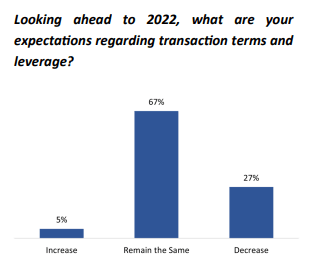

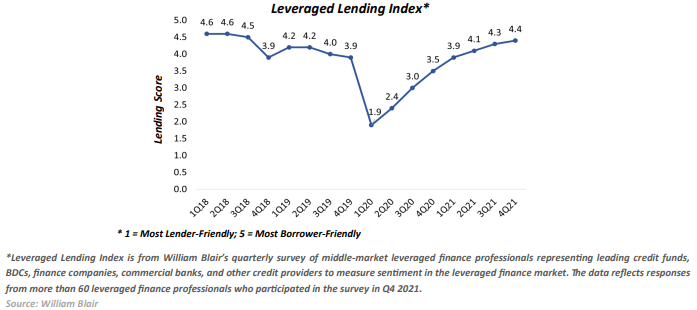

Debt financing markets continued to experience momentum in 2021. Transaction volume hit an all-time high, new financing options emerged, and private credit continued to increase its share in the capital stack of middle-market borrowers; these tailwinds have set the stage for a strong 2022. New-issue volume in leveraged loans hit an all-time high in 2021, topping $615 billion and more than half of the volume, approximately $331 billion, consisted of debt raised to support M&A activity (William Blair). The increasingly borrower-friendly landscape generated non-traditional concessions to win deals including aggressive pricing and leverage — a dramatic turnaround from Q1 2020.

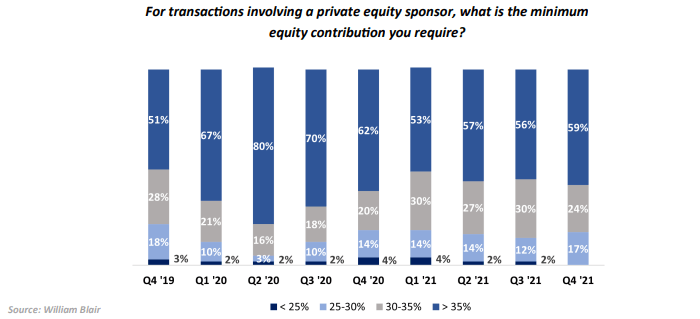

Middle-market leveraged finance professionals representing leading credit funds, BDCs, finance companies, commercial banks and other credit providers were surveyed regarding their attitudes toward the leveraged finance market. The data below and on the following pages reflects responses from the more than 60 leveraged finance professionals who participated in the survey from Q4 2021 (William Blair).

As the share of syndicated loans continued to fall in 2021, more middle-market borrowers sourced capital from direct lending or private credit outlets. Numerous transactions valued in excess of $1 billion topped direct lending markets in 2021. Although borrowers witnessed greater benefits and more flexible options through the direct lenders, it became increasingly difficult to access lender capital during the second half of 2021. The high volume of transactions in the market caused intermediaries such as law firms, accounting firms, and quality-of-earnings providers to frequently withdraw from the opportunity to engage or move quickly enough to meet transaction deadlines. Moving forward, issuers and sponsors may find it difficult to raise capital without additional assistance from investment banks or third party lenders.

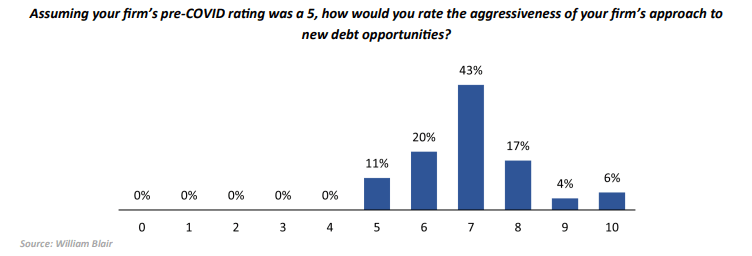

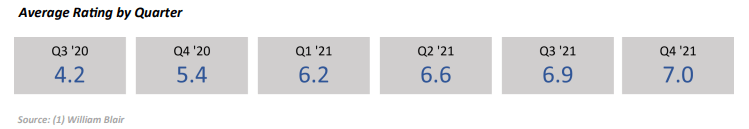

Despite the market being borrower-friendly, lenders are aggressively seeking new debt opportunities. Survey respondents reported lender aggressiveness towards new debt opportunities was at its highest since the start of the pandemic (William Blair).

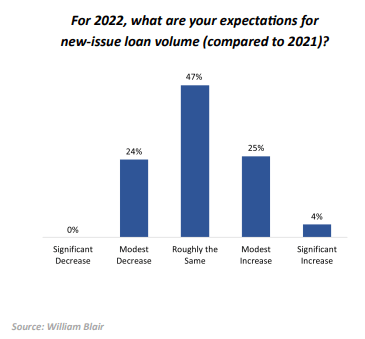

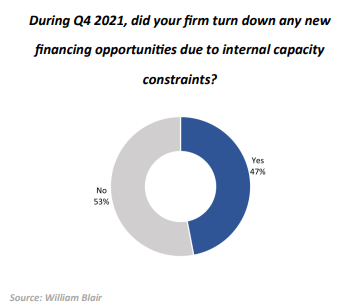

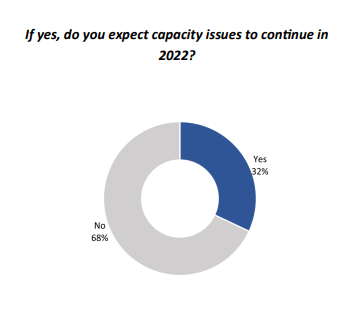

Conversely, lender respondents alluded to tight labor markets and hiring challenges. During

Q4 2021 lenders had to turn down new financing opportunities due to internal capacity constraints brought on by labor shortages. However, lenders have indicated their optimism towards loan volume in 2022 with the majority ofrespondents forecasting a strong year.

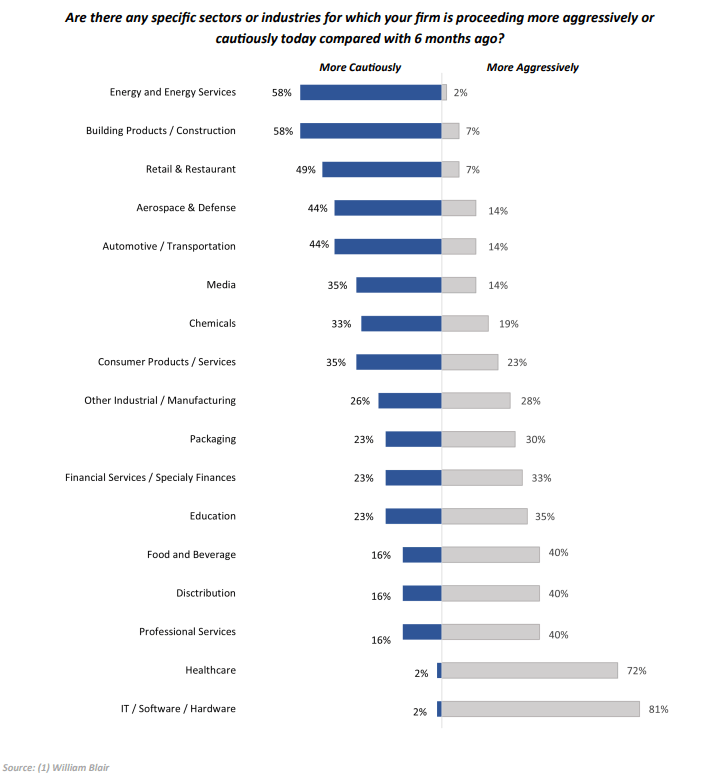

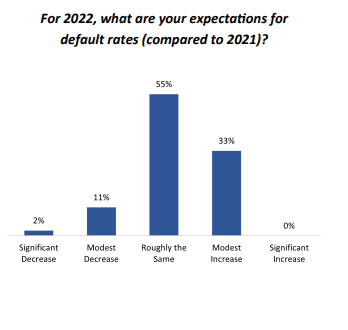

Availability of capital, M&A volume, availability of quality investments, inflation and interest rates, and the transition from the London Interbank Offered Rate (LIBOR) to the Secured Overnight Financing Rate (SOFR) are the most significant trends that lenders expect will affect the leveraged loan market in the coming year.

Additional factors and trends that hold significant impact on the market include:

- Fluctuations in Fed rates, monetary policy and inflation rates for labor and freight;

- High investor liquidity; and

- Increased use of covenants and continued growth in covenant-lite unitranche financings.