Performance Recap

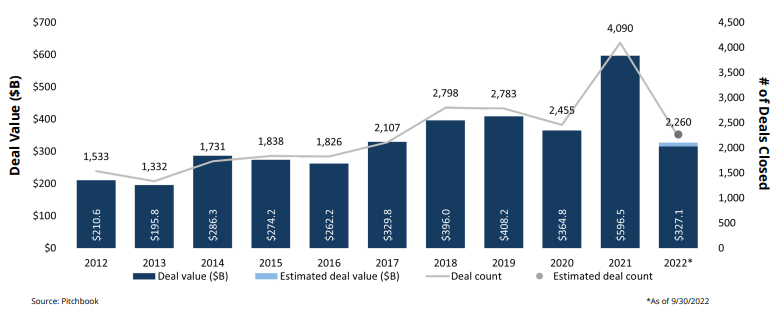

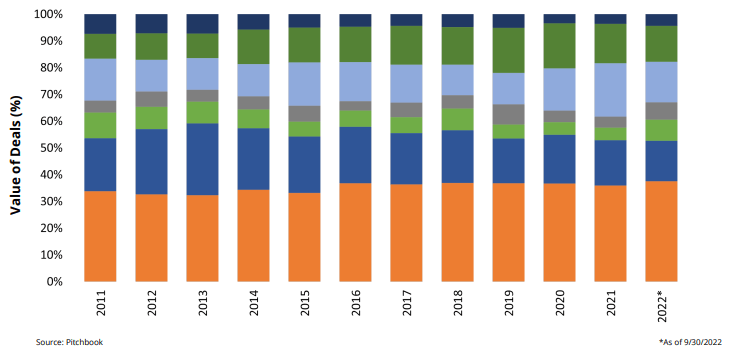

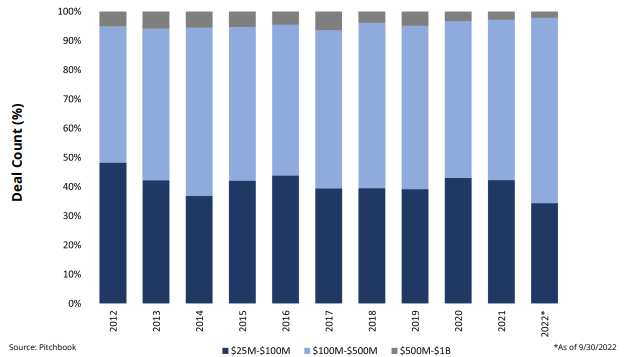

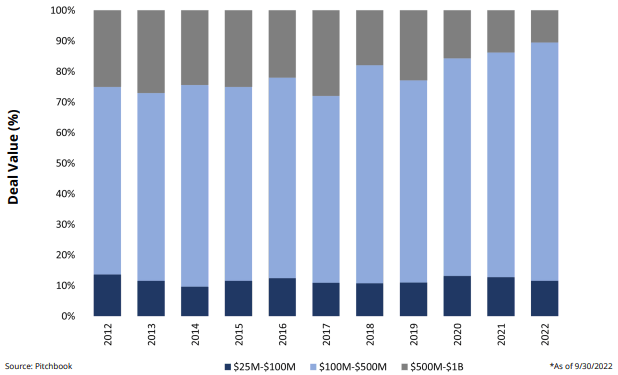

Current Middle Market Private Equity performance has shifted as a result of a suspected “valuation reset”. Overall activity through 2022 has reported significant decreases in comparison to 2021. Compression of Lower MM deal value has increased as the Core MM reported about 60% share of deal values for Q3 2022.

Private Equity firms have ample dry powder on-hand and are well-equipped to continue to seek out deals in the markets that has become cheaper by the quarter thanks to falling prices and lower public valuations.

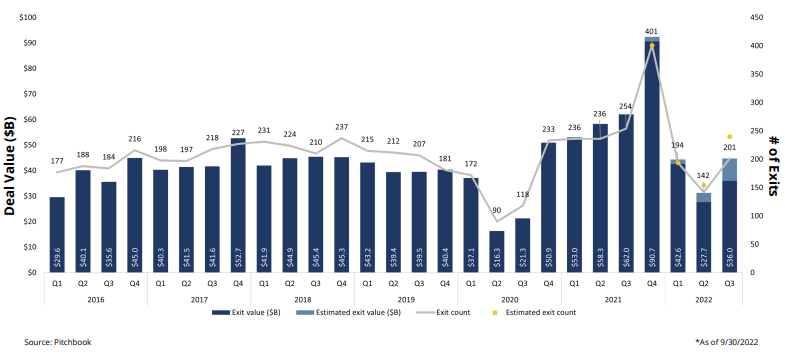

While the MM is generally less reliant on, and therefore less impacted by, the drought in new public listings and IPOs, reported exit values were down by more than half from the market’s peak in Q4 2021. Further activity within the middle market will remain challenging, regardless of the excess dry powder for PE firms.

Looking to the end of 2022, conclusions have yet to be drawn and uncertainty in the market is becoming more apparent.

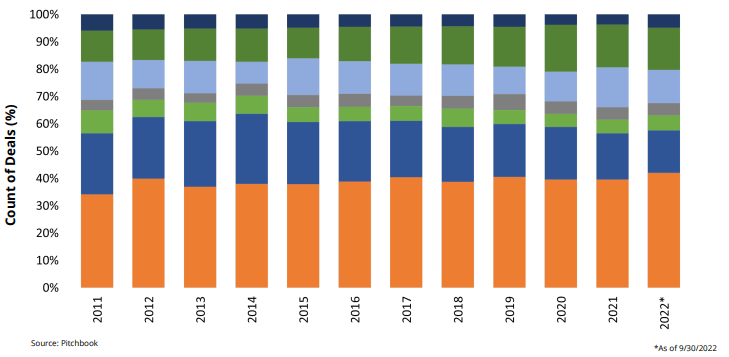

Private Equity Middle Market Transactions by Year

Private Equity Middle Market Exit Activity by Quarter

Private Equity Middle Market Exit Value by Sector