Introduction

The following report will discuss Private Equity (“PE”) transactions in the Middle-Market. Middle-Market transactions range from $10 million to $1 billion in deal size. The Middle-Market can be broken into three distinct segments: the Lower Middle-Market (“LMM”) with deal sizes ranging from $10 million to $100 million, the Core Middle-Market (“CMM”) with deal sizes ranging from $100 million to $500 million, and the Upper Middle-Market (“UMM”) with deal sizes ranging from $500 million to $1 billion.

Executive Summary¹

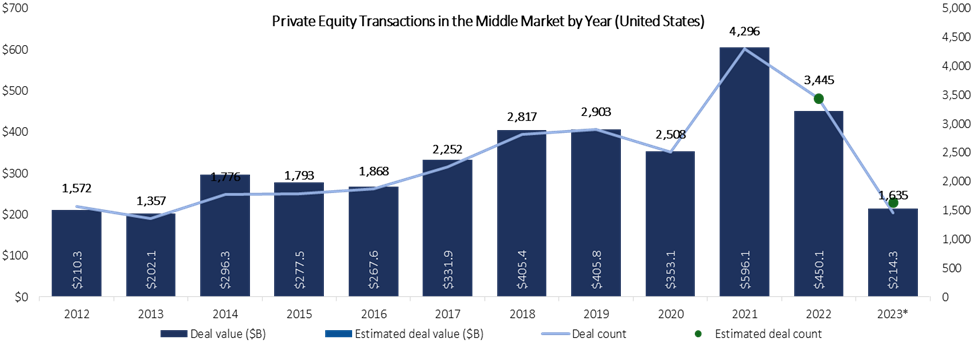

The Middle-Market continues to fire on most cylinders within the broader United States (“US”) PE buyout market. US Middle-Market funds, which Pitchbook defines as between $100 million and $5 billion in size, outperformed mega funds (funds of $5 billion or more) for three consecutive quarters heading into 2023, with the gap expanding to 9.7% as measured by median one-year horizon returns. This was the widest gap in favor of the Middle-Market since 2016 and a stark contrast to Q4 2021, when mega funds trounced all other funds by an impressive margin. The Middle-Market’s performance advantage contracted in Q1 2023 based on preliminary return data but is still solidly ahead, at 5.2%.

While PE activity has yet to reach heights like the 2021 peak, the Middle-Market’s share of PE buyouts is on pace for its strongest year ever and stood at 75.6% as of July 2023.

However, it’s not all blue skies ahead for PE players in the Middle-Market. Middle-Market exit activity experienced its weakest quarter since 2010 in 2Q23, as fund managers are positioning portfolio company, sales and demanding better prices.

To win in this clouded economic environment, PE firms must adapt to changing market conditions coupled with long-term trends that have become increasingly important in the US, including workforce trends, digital & cloud transformation, and Environmental Social Governance (“ESG”).