Focus on Plastics & Rubber Products

M&A

Activity

Plastics and rubber products mergers and acquisition activity in 2018 remained strong, with large, strategic transactions further consolidating the industry (i.e. LyndellBasell’s acquisition of A. Schulman Inc. and Amcor Ltd.’s acquisition of Bemis Co. Inc.), as well as smaller, more under the radar strategic bolt-on acquisitions. This momentum is expected to carry over into 2019, especially as the overall M&A environment remains favorable and strategic buyers aggressively hunt for bolt-on acquisitions.

Market

Dynamics

Oil pricing is a key market dynamic to watch in the overall chemical industry, including the plastics and rubber segments. The effects of a recent modest increase in oil pricing on raw materials inputs is expected to affect margins for compounders and players in the middle of the plastics and rubber supply chain. Rubber products (including latex; rods, tubes, and other products; conveyor belts; various types of transmission belts; various types of pneumatic tires; gloves; gaskets; dock fenders) are included on the current USTR list of goods affected by the Chinese tariffs.

Buy & Build

Strategy

Dry powder available to mid-market buyout funds remains robust (at over $300 billion) and continues to create a demand-heavy M&A environment, with private equity firms eager to put capital to work. The plastics and rubber segments continue to attract private equity interest as the highly fragmented component, molding and compound manufacturers represent aged opportunity for industry consolidation. Add-on acquisitions are a core pillar to portfolio company growth, accelerating expansion into different end-markets and/or geographies.

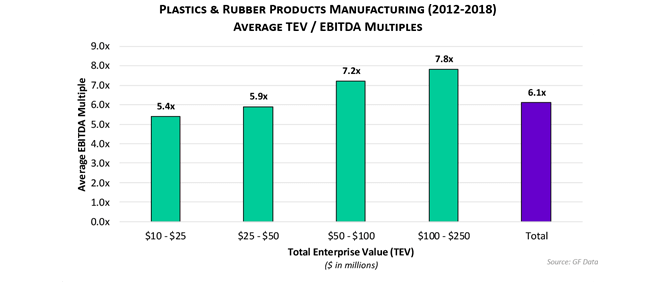

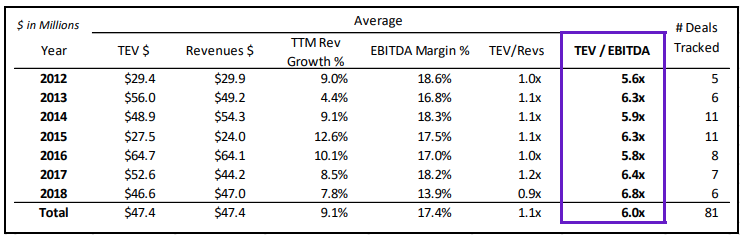

Plastics & Rubber Products Manufacturing

Compiled Private Equity Acquisition Deal Data - By Year (2012-2018)

Source: GF Data

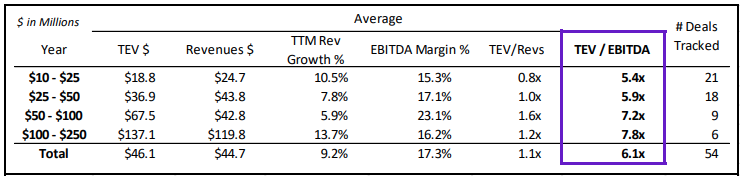

Plastic & Rubber Products Manufacturing

Compiled Private Equity Acquisition Deal Data - By Deal Size (2012-2018)

Source: GF Data

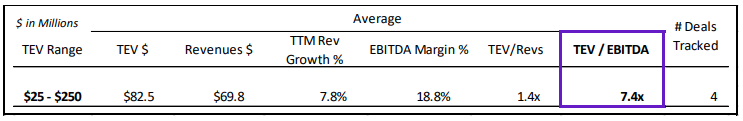

Plastics & Rubber Products Manufacturing

Compiled Private equity Acquisition Deal Data (2012-2018)

Source: GF Data

There are four reported transactions that identify as rubber product manufacturing, with enterprise values falling between $25 million and $250 million. Deal multiples for these transactions are slightly higher than the compiled plastics and rubber manufacturing companies, averaging 7.4x EBITDA. This can be attributed to industry and end-use factors. As the data above demonstrates, companies with smaller TEV experience lower multiples, while companies with higher TEV typically experience larger multiples.

2018 Rubber Products M&A: Minnesota Rubber & Plastics Case Study

Quadion, LLC d.b.a Minnesota Rubber & Plastics (“MR&P”) is a provider of molding and assembly of products made from elastomers and thermoplastics. The Company operates global engineering and manufacturing facilities. MR&P’s deep materials science expertise offering full-service capabilities that range from engineering mission-critical components to providing complete manufacturing solutions for technically demanding applications. MR&P focuses on three core areas: automotive/transportation, water/beverage and medical.

The Company was founded in 1945 and the small, family-owned business experienced three generations of leadership, transforming MR&P into a global corporation with 1,100 employees and nine facilities worldwide. MR&P was acquired by Norwest Equity Partners (“NEP”, a local, Minneapolis-based private equity firm) in 2012 with the intention to continue global growth into China as well as the medical end-use markets. Over its six year holding period, NEP invested significantly in the company to establish a strong foundation for further growth. Investments include a $20 million upgrade to machinery and equipment, as well as building out MR&P’s infrastructure. Additionally, under NEP’s direction, MR&P established its three core end markets (see above) which were previously undefined and had overlapping processes and equipment. Under NEP’s direction, the Company further enhanced its focus on the medical segment, which has quickly become MR&P’s fastest growing segment.

NEP sold MR&P to KKR & Co., LP in late 2018, for an undisclosed deal value. In the competitive sell-side process, KKR stood out above the other buyers based on the firm’s commitment to growing the business and taking care of employees. KKR also brings a global reach and a strong network to assist MR&P’s growth, in addition to resources and experience in executing strategic acquisitions.

Carleton McKenna Specialty Manufacturing & Chemical Transactions