The phrase “second bite at the apple” is commonly used to reference a sale transaction where the business owner retains a minority position in the company post-transaction. This type of transaction – a Majority Sale – is typical when business owners sell to financial sponsors (such as private equity). Buyers must acquire over 50% for the acquisition to be considered a Majority Sale, but 60-85% is the most common range. The business owner takes money off the table, but she retains a meaningful percentage of equity ownership. In the most common structure – an asset purchase, the owner can usually “rollover” proceeds in a tax efficient way in order to retains this minority position. The “second bite” comes when the new majority owner decides to sell, and the original owner cashes out again in the second transaction.

An example of a positive “second bite” transaction is explored in this brief overview.

The First Bite

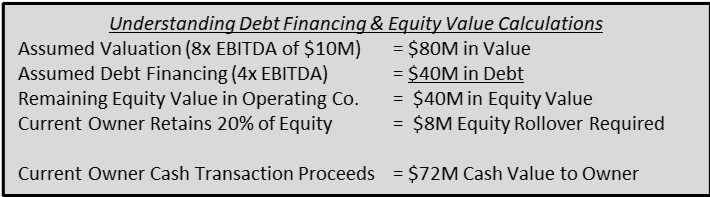

The following example outlines a transaction scenario for a $10M EBITDA business valued at an 8x EBITDA multiple, or a $80M valuation. In this scenario, the current owner decides to rollover some of her proceeds into the new ownership structure for a 20% ownership stake (i.e. financial buyer acquires 80% of the operating company). However, this does not necessarily mean that the current owner will have to reinvest $16M to maintain a 20% stake in the operating company (20% of $80M = $16M). Most financial buyers – and many strategic buyers – will leverage the transaction with a portion of debt financing, as presented on the next page.

In this scenario, the bank or other financing source determines that the appropriate leverage is 4x EBITDA, or $40M in total debt. Assuming a $80M valuation, this results in $40M in equity required to complete the sale.

Of the required $40M in equity, the current owner would rollover $8M of her proceeds to hold a 20% position in the operating company (20% of $40M = $8M). Post-transaction, the current owner receives $72M in cash and maintains 20% ownership of the operating company.

The Second Bite

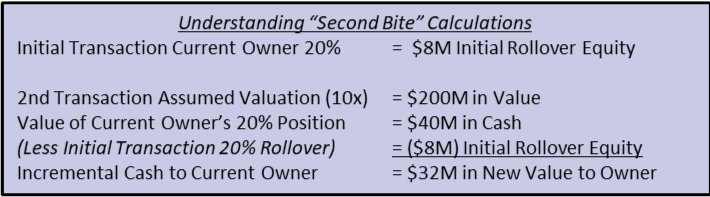

The “second bite” comes when the operating company is sold again. Timing and process, of course, are managed by the initial buyer since they are the controlling shareholder. In this scenario, we assume that with a smooth transition and the operational assistance, professional guidance, and financial backing of the buyer, the operating company grew EBITDA by 100% to $20M in 5 years, and paid off the $40M of original debt. With this increase in earnings, the EBITDA multiple used in a valuation typically increases. Assuming a new valuation of 10x EBITDA when the operating company sells again, the valuation would be $200M.

If the current owner decides to cash out completely and does not rollover any of her equity value into the new deal, she would receive $40M in cash. The current owner’s original $8M rollover investment would be worth 5x that value in a 5-year period. This example assumes everything goes swimmingly, and of course that is not always the case – rollover equity is subject to real economic risk. However, when things go right a rollover investment can produce a pretty terrific incremental return – a very nice “second bite at the apple.”

The appropriate pre-transition planning can assist first-time sellers (i.e. nearly all business owners) in understanding the various transition options. Choosing which strategy is best for the business owner personally, and for the future of the company, is a vital component when making an exit plan and considering rollover equity.