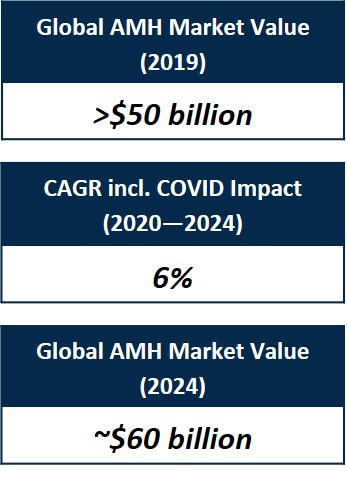

The Global Automated Material Handling Market — the market for automated equipment used in warehouses for managing the storage and transportation of goods and products, reducing or eliminating the need for human interference — is poised to grow by $9.1 billion (a CAGR of 6%) during the forecast period 2020-2024. Key factors driving industry growth include:

- Rising demand for automation and modernization in manufacturing processes;

- The steady demand for transparency in supply chain and flexibility in warehouse operations; and in particular,

- The expansion of the e-commerce industry, which has experienced rapid growth from the onset of COVID-19 stay-at-home and social distancing directives.

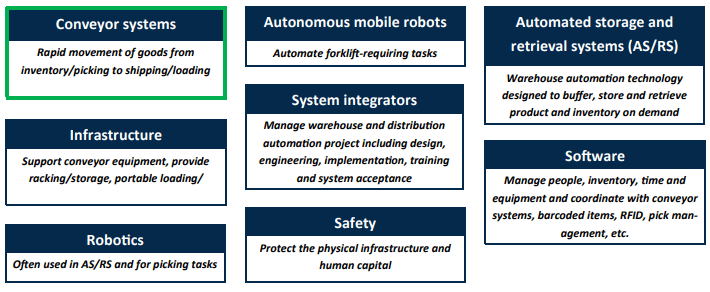

Areas ripe for investments and consolidation:

High-Demand Categories in Material Handling

The AMH market is highly fragmented with many middle-market participants excelling in specific product categories and end-market applications. As warehouse distribution and automation processes continue to advance, both corporations and private equity firms alike can benefit from resulting M&A opportunities.

Strategics will likely seek out opportunities to broaden product capabilities, form more comprehensive solutions, and increase expertise in high-growth, end-market applications. Private investors will be attracted to AMH companies that hold defensible market positions and are able to benefit from favorable e-commerce tailwinds.

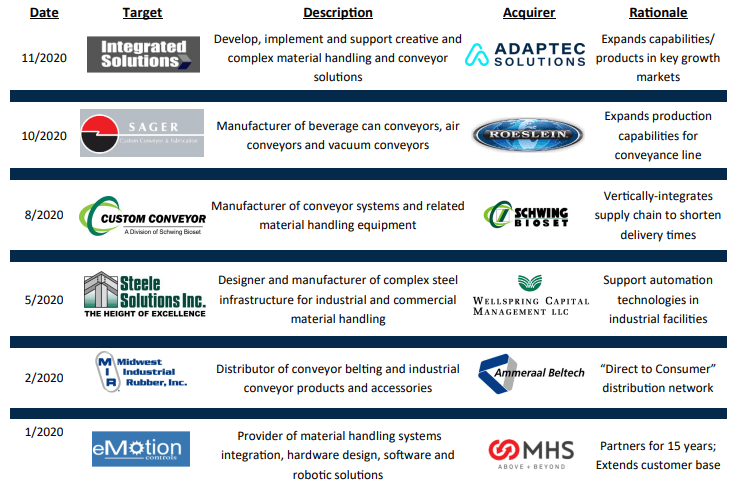

Select recent acquisitions in AMH and Conveyor Systems:

Large demand for conveyor systems across warehousing and manufacturing industries

Conveyor Systems as a Sub-segment of the AMH Market

Conveyor systems serve various end-use industries, including automotive, chemical, rubber and plastic, aviation, semiconductor and electronics, e-commerce, food and beverages, meta, and heavy machinery, as well as others requiring bulk and unit load material handling.

Trending automation and technological advancements in these industries are pivotal factors contributing to the growth of the material handling equipment market and the increasing demand for conveyor systems. Manufacturers ho can offer exceptionally reliable and efficient conveyor systems in a short time can gain a clear competitive edge in the conveyor system segment.

Further, investment in research and development may also create opportunities for conveyor system manufacturers serving end-markets that do not necessarily benefit from factory automation—i.e., chemical, pharmaceutical, automotive and transportation. These industries seek to invest in technologically-advanced material handling equipment that can yield operational cost savings, reduce throughput time and improve accuracy.

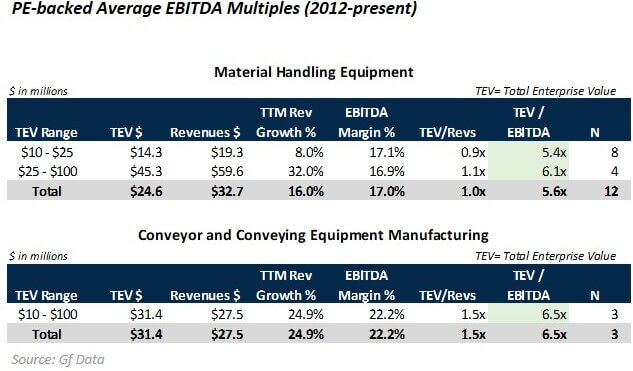

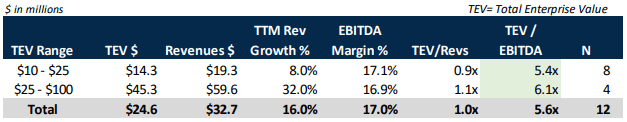

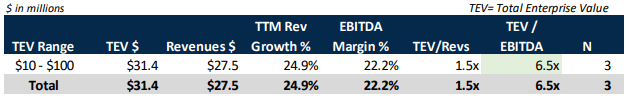

Companies offering high-demand characteristics will likely exceed average valuations

PE-backed Average EBITDA Multiples (2021-Present)

Material Handling Equipment

Conveyor and Conveying Equipment Manufacturing

CM&Co has significant experience in the Material Handling soace

Select Recent Transactions

Webster Industries, Inc. is currently seeking strategic add-on opportunities. CM&Co is acting as exclusive advisor to this components and integrates systems manufacturer as it maps industry-related opportunities to prioritize targets, manage introductions, facility and develop inter-company relationship, and execute attractive acquisition transactions.

CM&Co has extensive and current advisory experience in the material handling space. As exclusive financial advisor to Mayfran International, Inc., CM&Co assisted in buy-side analysis and negotiation of a bolt-on new technology for this material handling business. Additionally, executives at CM&Co have prior multi-year equity ownership experience as direct investors in this industry.

With additional transaction experience valuing material handling businesses, and as a sell-side and buy-side M&A advisor, CM&Co is active in this market—enabling our team to provide time-sensitive market information to our clients while efficiently acting on new leads and strategic opportunities.