During the first half of 2020, COVID-19 created unprecedented disruption in the Building Products industry (industry includes companies that manufacture and/or distribute building systems and components) as lockdown measures and supply chain challenges significantly impacted industry demand and downstream markets. However, as lockdown measures ease and building products participants move towards a more normalized workload, industry demand and unemployment rates are displaying signs of a rebound.

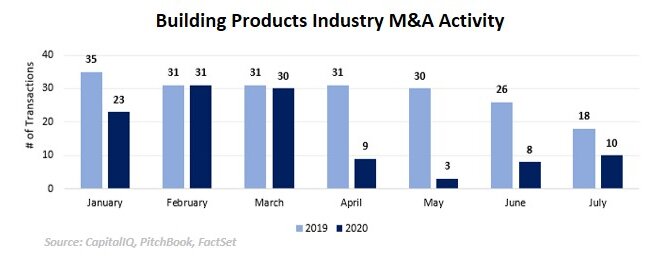

Building Products M&A activity in Q1 2020 moderately trailed Q1 2019, but fell off significantly in Q2 as a result of the pandemic. Volume picked up in June and July as strategics began to revisit M&A activity after focusing on internal cash flow and liquidity preservation. While continuing uncertainties and the longer-term impact of COVID-19 has yet to manifest, industry participants must look to address new workforce protocols through implementation of innovative technologies and investment in remote or machine-controlled equipment during the upcoming months.

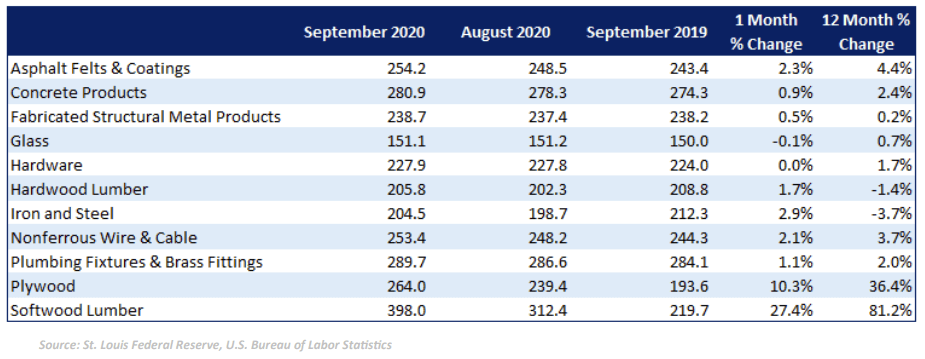

Producer Price Index—Commodities Construction

Index Base Year 1982 = 100, Not Seasonally Adjusted

According to the U.S. Bureau of Labor Statistics, select materials prices experienced significant increases. In particular as of September, softwood lumber, a key input in home construction, is experiencing growth of approximately 81% YoY and 27% MoM, primarily as a result of supply constraints.

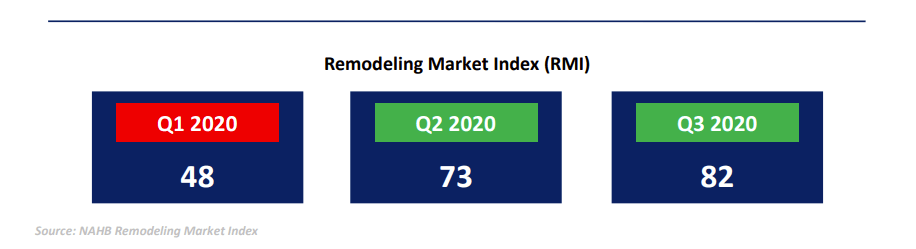

The remodeling Market Index (RMI) is based on a quarterly survey of National Association of Home Builders (NAHB) remodeler members that provide insight on current market conditions as well as future indicators for the remodeling market. The RMI survey asks remodelers to rate their sentiment towards five aspects of the remodeling market as “Good”, “Fair”, or “Poor”. The five aspects include: 1) current market for large remodeling projects; 2) current market for moderately sized remodeling projects; 3) current market for small remodeling projects; 4) current rate of leads and inquiries; 5) current backlog for remodeling projects. Each question is measured on a scale of 0 to 100, where an index number of 50+ indicates that a higher share of remodelers view conditions as good rather than poor.

The RMI posted asreading of 82 in Q3 2020, carrying on the momentum of substantial rebound in Q2. Current market conditions were highest amongst the Small Remodeling Project subcomponent (index score of 90), followed by the Moderately-Sized Remodeling Project subcomponent (index score of 86).

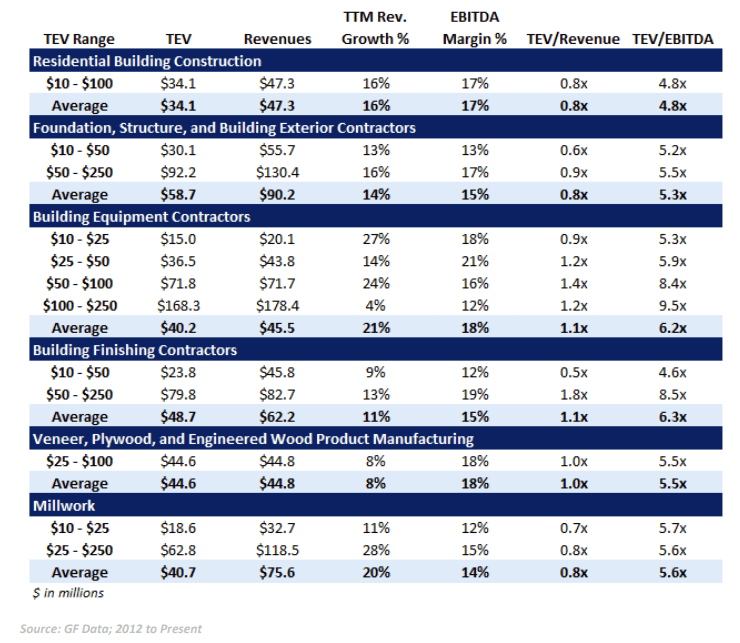

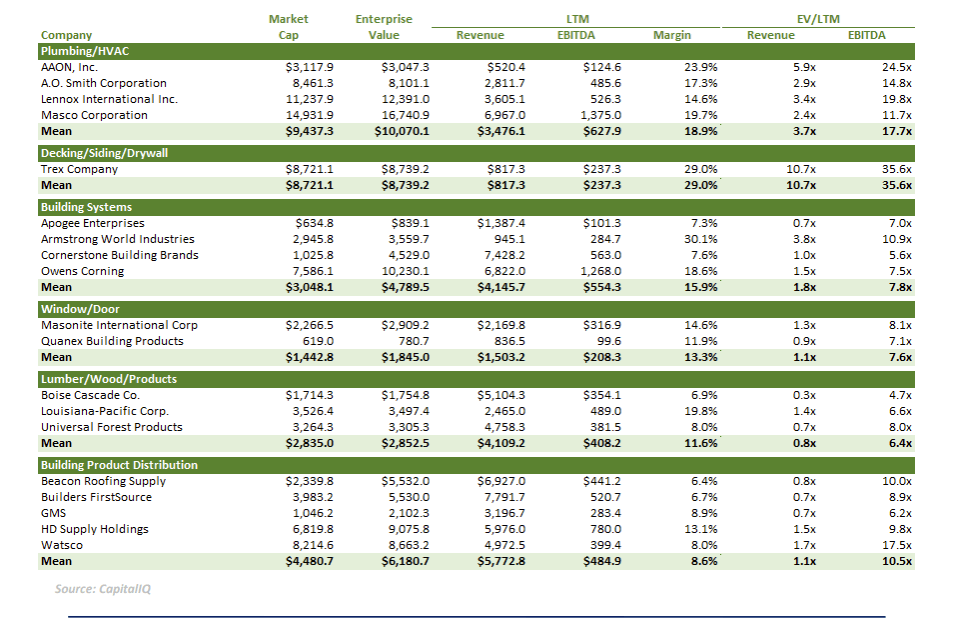

Public Company Trading & Operating Data

Construction Market Dynamics—Downstream Demand

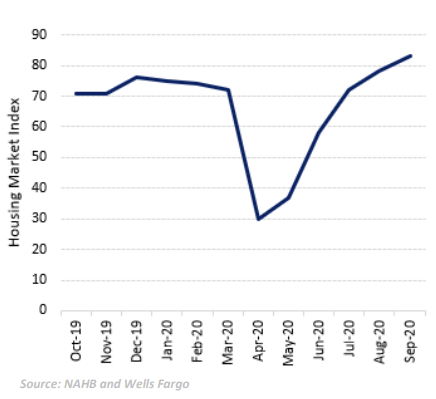

NAHB National Home Index Market

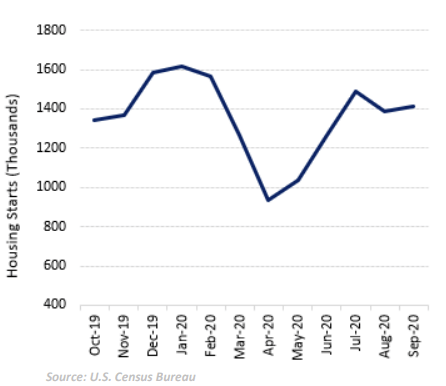

U.S Housing Starts

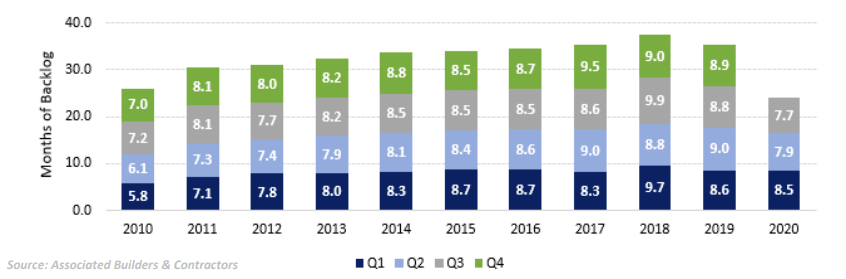

Construction Backlog Indicator (CBI)—National Backlog Average by Quarter

The Associated Builders and Contractors (ABC) Construction Backlog Indicator (CBI) is a forward-looking national economic indicator that reflects the amount of work that will be performed by commercial and industrial contractors in the coming months. Backlog dropped to 7.7 months in Q3 2020, declining YoY and dropping further below 5-year averages.

Recent Notable Transactions

September 1, 2020

Foundation Building Materials, Inc. (NYSE: FBM), one of the largest specialty distributors of wallboard, suspended ceiling systems, metal framing and complementary products in North America, acquired Marriott Drywall Materials, Inc. Marriott is an independent distributor of drywall and accessories, steel framing, insulation, tools and fasteners, and has a 22-year track record serving the Greater Milwaukee, Wisconsin area. Terms of the transaction were not disclosed.

August 31, 2020

Installed Building Products, Inc. (NYSE: IBP), an industry-leading installer of insulation and complementary building products, announced today the acquisition of Storm Master Gutters. Founded in 1977, Storm Master is headquartered in Cherry Hill, New Jersey and primarily provides gutter installation services to residential and multi-family customers throughout New Jersey, Pennsylvania, Delaware, Maryland, Massachusetts, Virginia, New York, West Virginia and Tennessee. The company generate approximately $20 million of revenues.

July 27, 2020

Armstrong World Industries (NYSE: AWI) has acquired leading manufacturer of custom felt ceiling and wall solutions, Turf Design, for an enterprise value of $118 million, equivalent to 4.7x revenue. Turf Design operates an 8,000 sq. ft. innovation center and a 75,000 sq. ft. fabrication facility. The acquisition bolsters Armstrong’s design and manufacturing capabilities and expands its architectural specialties and wall solutions offerings.

Private Equity Interest In Building Products Related Industries

Financial buyers (typically private equity sponsors) remain highly active across the Building Products industry. Although strategic buyers account for the majority of transactions, financial buyers should not be overlooked when considering an exit. Across the U.S., private equity groups are looking to put meaningful capital to work and are aggressively seeking middle-market transactions in building products manufacturers, distributors and service providers.

According to reported private equity transactions, financial buyers are willing to pay on average between 4.5x and 6.5x EBITDA multiples for the right platform acquisition across the following sub-categories: