The Beer Distributor's Road Ahead

Varying Regulations Across States

Since Prohibition ended in 1932, the three-tier distribution system has remained a constant in today’s booming alcoholic beverage industry. Whether it be to hinder the expansion of one company or to encourage growth within another, the three-tier distribution system has sustained long-term revenue growth through the separation of producers, distributors, wholesalers and retailers.

Alcoholic beverage sales account for 16.5% of the total beverage volume in the US. Though the percentage might seem small in comparison to the entire beverage market (alcoholic and non-alcoholic), alcohol sales accounted for $261 billion in revenues in 2021.

Anheuser-Busch InBev SA/NV (ABI) and Molson Coors Beverage Company (Molson) further segment the alcoholic beverage industry into a monopolistic-like landscape with a combined market share of about 64%. However, varying regulations across state lines and frequent Federal Trade Commission (FTC) investigations work to maintain the ABI and Molson influence within the industry (US Treasury).

Direct-to-Consumer Distribution

The three-tier distribution system has slowly become a two-tier system in Colorado and California. The producer and distributor have combined roles, leaving the retailer untouched. For example, ABI is now buying out distributors or distributing their own beer without restrictions (IBISWorld).

Distributors offer select services that include marketing brands to on- and off-premises retailers, setting up bottle displays, arranging shelves, printing menus and providing any additional branding and logo placements. Not every state allows all of the aforementioned distributor activities and, in some cases, the purveying of “free” labor may violate federal laws (US Treasury).

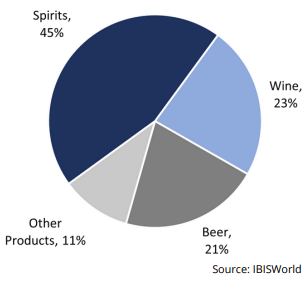

Alcoholic Beverage Sales by Segment

- Varying distribution services and state-mandated franchising laws generated price competitions between distributors to mitigate the increase in production cost.

- Over time, craft brewer industry growth began to stagnate while national beverage producers and distributors were able to dull the negative effects of price hikes.

- By nature, direct-to-consumer distribution offers distinct distribution opportunities for small producers and distributors, and opportunities for innovation.

Due to the growing gap between national and local producers and distributors, numerous states imposed “post-and-hold” regulations which have become synonymous with undermining price competition (US Treasury). Despite the Fed’s continued interest rate hikes, price wars have the potential to gradually drive up the cost of a bottle of wine by 18% and a bottle of spirits by over 30% according to a report by the American Craft Spirits Association (Reuters).

Consumer spending has risen substantially as beverage preferences have shifted in favor of premium products including craft beers, top-shelf liquor and wine aged beyond 15 years. During the Great Recession of 2008, per capita expenditure on alcohol increased 1.4% during the recessional period and slowly declined from its peak later in 2009.

Current per capita expenditure on alcohol is trending in a similar fashion compared to the Great Recession, however, contrary to that eventual decline in consumer spending, the post-pandemic economy continues to purchase alcoholic beverages with increased fervor regardless of the higher purchase price. Researchers predict the forecasted value of alcohol expenditures will surpass $753 billion by 2027, up$82 billion from 2022 (IBISWorld).

Craft Beer Boom Across Industries

ABI and Molson are working to balance the shift in consumer preference. Greater interest in craft beers and premium imports has shifted market share and revenue from the traditional American beer market. For this reason, the beer industry is heavily segmented based on product offering and allows consumers to deviate from the larger manufacturers like ABI and Molson to craft beers (IBISWorld).

The argument behind the new variation in consumer predilection is based on a number of factors including the attention to detail, range of styles, quality ingredients, high degree of expertise and overall freshness offered by craft brewers (IBISWorld).

Craft beer consumption has erupted to become one of the fastest growing segments of alcoholic beverage sales in the U.S. despite the economic volatility produced by the COVID-19 pandemic. As a result, nonessential business closures hindered revenue streams through on-premise locations such as restaurants, bars and in-house tasting rooms. However, operators with strong distribution networks were able to focus on off-premise locations, including liquor, grocery and drug stores.

Beginning in 2021, harsh economic conditions eased and the craft brewing industry rebounded from pandemic losses, but profit is expected to grow at a slightly slower pace during the forecast period (IBISWorld).

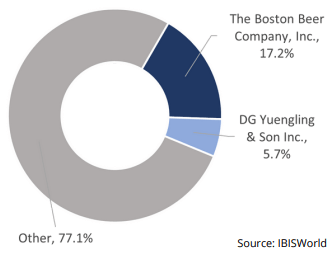

Craft Beer Industry Leaders

Regardless of the anticipated stagnation, the gradual decreases in excise taxes and rise in consumer expenditures offers a favorable environment for new entrants and exits.

Distributors and craft brewers alike will experience expansion through an increasing number of facilities actively producing and selling craft beverages. Dominant brewers are likely to maintain merger and acquisition activity. Continual expansion and consolidation will likely provide brewers with the opportunity to generate greater profits in the coming years.

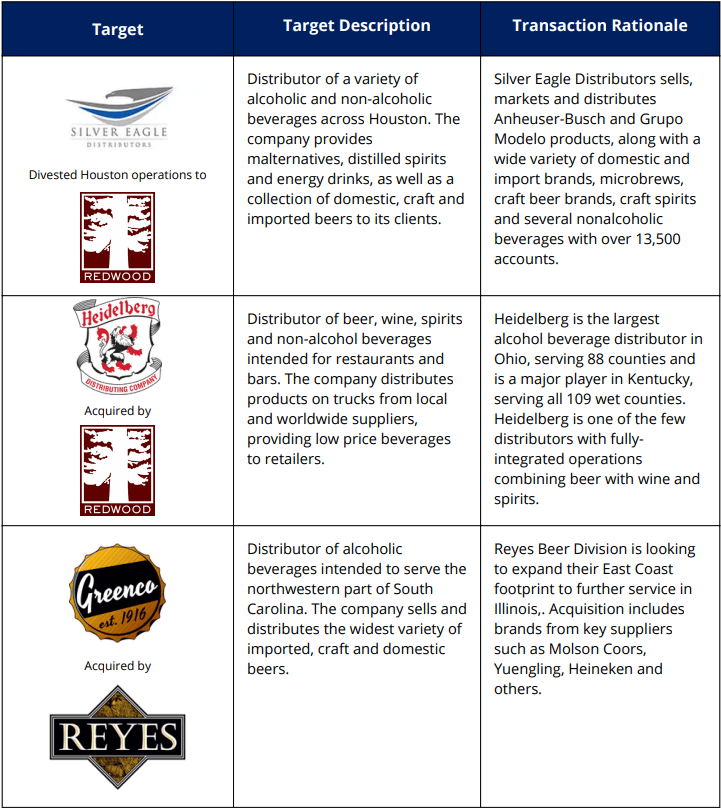

Select Case Studies

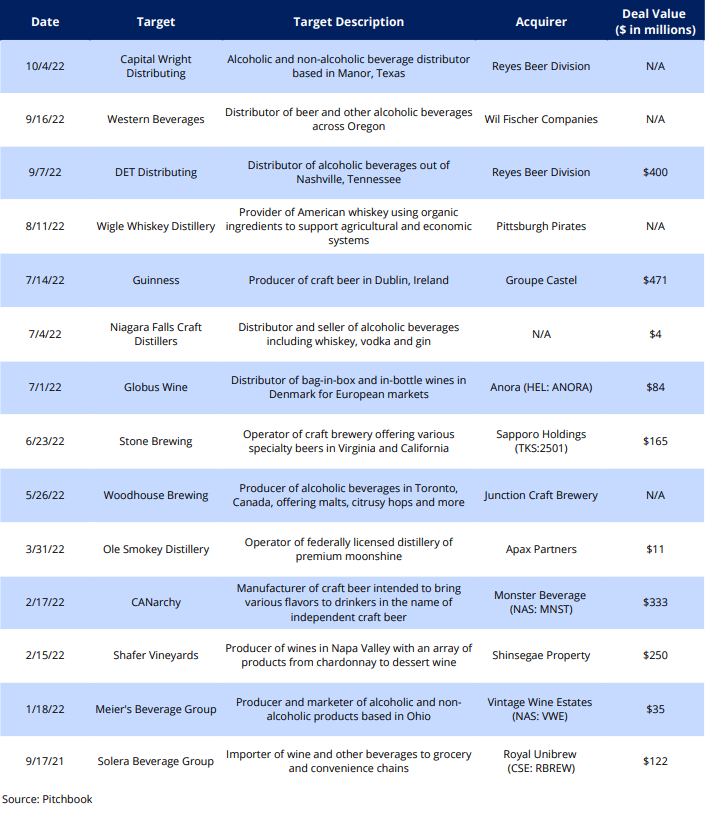

Select M&A Transactions