Surveying and Mapping Industry

Expectations

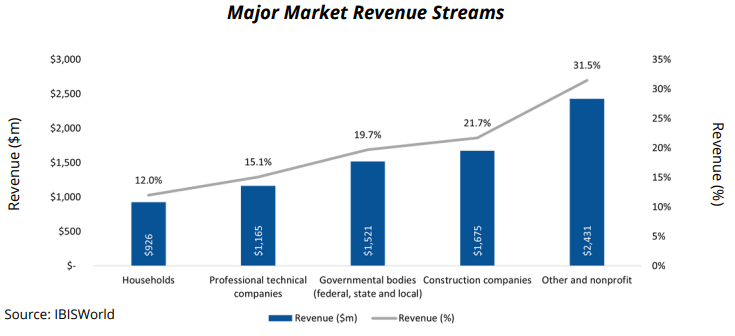

The Surveying and Mapping industry relies on downstream demand and performance from five market segments including (a) building and construction companies, (b) government departments and agencies, (c) land development companies, (d) professional service operators and (e) utility and mining operators (IBISWorld).

The industry profited from relatively low interest rates over the past five years, though market conditions are fluctuating as the once strong borrowing environment for residential and non-residential clients is shifting in favor of the lender.

Residential construction opportunities are predicted to continue decreasing in revenue potential as inflation and supply costs hinder consumer demand. Most notably, the record low mortgage rates during the pandemic have since surpassed 5% (Freddie Mac).

Over the next five years, strong growth for non-residential construction is expected, propelled by the issuance of government contracts. Hospitals, commercial buildings, railroads, factories, and other infrastructure projects generate a significant portion of business for mapping and land surveying services, but will not be the key focus for short-term contracts. Industry operators that serve highway, water, sewer, or electric infrastructure markets have the greatest potential for revenue growth as these demands are more easily met post-pandemic.

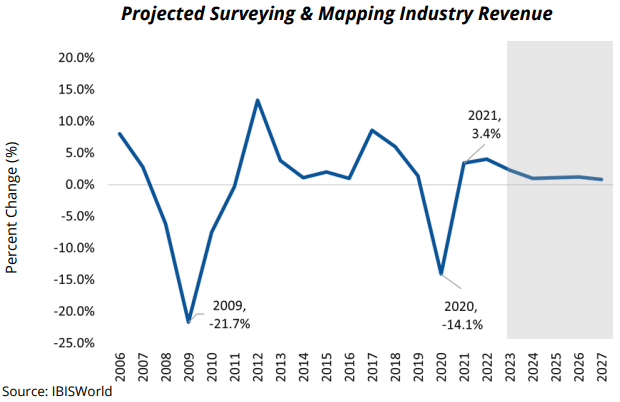

Companies are taking advantage of the new business cycle despite the increase in financing costs. Industry revenue has steadily increased since the start of 2021 and is expected to continue at a subdued annualized rate of 1.9% from $7.7 billion to about $8.5 billion over the next five years (IBISWorld).

Product & Service Demand Variables

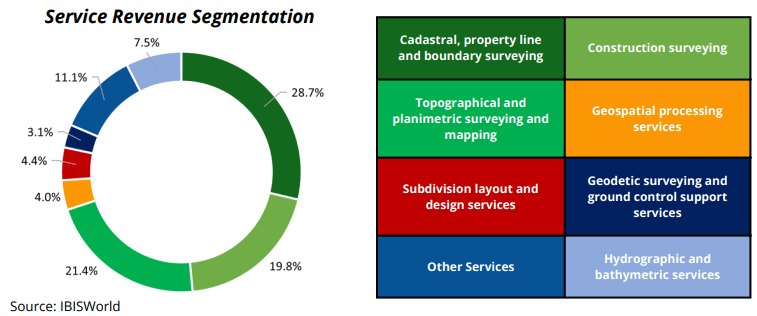

Traditional cadastral surveying is the predominant revenue driving segment within the surveying and mapping industry over the last five years, but the rise of topographical and planimetric services have shifted the landscape. Government contracts are increasing in number and consumer demand fluctuations are generating an ebb and flow to various revenue streams.

Construction surveying and government contracted work are key determinant markets that will dictate profit margin growth within the industry. Construction surveying is responsive to interest rates, amongst other factors, such as inflation rates, labor shortages and supply chain issues (Rea & Associates). Construction surveying revenues are projected to increase into 2027, shifting projected industry revenue streams.

Though non-residential construction is set to gain momentum, the majority of demand will be fulfilled by engineering companies that are expanding their services into the Surveying and Mapping industry (IBISWorld).

Competitive Trends

The Surveying and Mapping Services industry is characterized by high regional competition though competitive conditions are considered to be stable in the long-term.

Short-term trends are determined by the technological capacity of operators within each region. More operators are incorporating advanced technology in their services, creating a decline in industry employment. Additionally, the purchase price for advanced technologies is being placed on the client in exchange for greater accuracy and attention to detail from the service provider.

The transition to advanced services is spearheaded by large-scale companies partaking in long-term contracts with government agencies. For example, the National Geospatial Program (NGP) and the Federal Emergency Management Agency (FEMA) sign annual contracts with industry leaders like The Dewberry Companies, Inc. (IBISWorld).

Medium- and small-scale businesses often obtain contracts through regional advertising and referrals. However, external competition from engineering and architecture companies is disrupting the current market share structure.

Engineering companies boast the greatest threat to current industry leaders. Engineering companies often provide an integrated service wherein revenue generation is achievable at a lower cost to the client and provides added convenience for the client. These “one-stop shops” are disrupting and will continue to disrupt the current Surveying and Mapping industry structure.

New market entrants deal with increased competition on a regional scale, as most enter the market with an already developed portfolio of client experience before establishing themselves in the industry. Competition will continue to steadily increase with the emergence of advanced technology and fully-integrated service offerings.

These two factors may restrict new entrant capacity and capabilities within the maturing industry. The best outcome for profit gain is to remain localized, compete in the smaller end of the market, and operate at a low start-up cost with a focus on traditional services and equipment.

Overall revenue is projected to decrease as large firms compete for market share and external industries overtake potential profits.

Growth Restrictions & Regulations

Two regulatory bodies govern the surveying and mapping industry, the American Land Title Association (ALTA) and the National Society of Professional Surveyors (NSPS). Minimum standards set by both regulatory bodies must be met on an annual basis. The NSPS also serves as a political action committee and represents the interests of the surveying community in Washington, D.C.

Professional regulations are proceeded by state and federal regulations; agencies that perform contracted work at the federal or state levels operate in line with set standards regarding methodology and data accuracy.

Additionally, the International Organization for Standardization technical committee is responsible for the international standardization of geodetic and survey instrument standardization. Regulatory requirements are expected to increase in number and remain a heavy deterrent to new entrants. Subsequently, merger and acquisition activity is steady as smaller companies are the target of large regional or national companies looking to improve their economies of scope.

Post-pandemic Volatility

The pandemic attributed to an estimated 14% surveying and mapping revenue reduction in 2020. However, the industry has progressed through 2021 with increased vivacity and profitability. Over the next five years, construction contracts and government spending are predicted to mitigate industry volatility (IBISWorld).

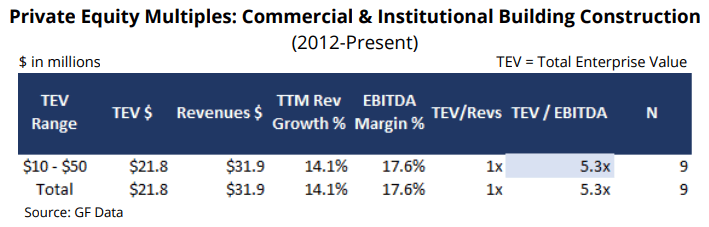

Commercial Building Construction

Rising per capita disposable income for consumers generated a surge in downstream demand through property rental, housing construction and building material purchases. Industry revenue is projected to grow at an annualized rate of 3% to $267 billion by 2027. However, the growth of revenue and surge in consumer spending could be subverted by the Federal Reserve’s interest rate regulations (IBISWorld).

As greater demand generates the need for expansion by businesses, additional space will be required and the downstream need will continue to build commercial construction demand. Businesses have recently coped with greater volatility in downstream markets by operating within a low cost structure while also maintaining productivity.

In the post-pandemic commercial building construction industry, traditional general contractors and architect-designer roles are expected to converge through economies of scale. Industry structure is changing as companies increase their house service offerings like developing blueprints, rendering, among other services. Subcontractors are losing market share as mergers and acquisitions by major industry players bring more services in-house and reduce the need to outsource.

Commercial Real Estate

Similar to the Commercial Building Construction industry, the Commercial Real Estate industry relies heavily on consumer demand. Per capita disposable income affects market activity and building availability, though construction activity is anticipated to rise over the next five years. Consumer spending in commercial real estate is projected to increase at an annualized rate of 2.6% to 2026, while the value of non-residential construction is expected to increase at an annualized rate of 2.7% during the period of time (IBISWorld).

Low vacancy rates, low unemployment and increased telecommunications through internet accessibility offer opportunities for growth and threats of increased competition. At a time when commercial real estate is inexpensive, consumers are dictating the profitability of the commercial real estate industry while inflation continues across the US.

In the wake of economic uncertainty, commercial tenants must remain flexible and focus on short term property rental and more on e-commerce as a means of deleveraging the necessity for commercial space. As this lowers risk for the tenant, property owners are expected to see a drop in revenue in the short term, thus decreasing the demand for surveying and mapping service.