Evolving Value-Added Capabilities

Business process outsourcing (BPO) firms furthered their relevant positioning through Q3 2021 as these businesses continued to deploy sticky, value-added solutions to clients and end customers—these efforts have not gone unnoticed by capital allocators. Completed deals during the quarter particularly favored back-office support services across multiple organizational functions including finance, insurance (both carriers and ancillary services) and legal as secular calls to safeguard proprietary data collection are here to stay. Contact centers with a focus on customer experience prioritization, tech-enablement, and cloud-based solutions continue to notch favorable deal volumes as well.

COVID-19 has transformed the way businesses look to outsource services. The pandemic’s macroeconomic implications have accelerated the adoption of outsourced services as businesses turn to creative solutions to alleviate immediate operational concerns, such as (i) stretched supply chains, (ii) inflationary pressures and (iii) widespread labor shortages.

Back-office Support Functions Come to the Forefront

The rise in sensitive client and proprietary data processing and handling has led businesses, namely financial institutions, insurance providers and law firms, to outsource support services. Professional services firms demand robust back-office headcount to support record maintenance, settlement and regulatory compliance functions. BPO providers have increasingly moved online to deliver flexible back-office functional support, alleviating repetitive overhead commonly found in professional firms and enabling service execution in a more efficient manner.

Contact Center Highlights

With much of the world working from home, questions and concerns around home entertainment services and e-commerce orders have taken on new importance; and it is likely these questions are fielded through a remote contact center workforce. This customer-brand interaction is beneficial because companies can log direct customer feedback that would otherwise have gone unnoticed. However, the more a customer interacts with a company (e.g., advertising, service and returns), the less profitable that customer becomes. BPO models have allowed clients to indirectly service customer inquiries amidst unparalleled volumes, providing omnichannel service delivery otherwise unattainable for the client given financial and operations constraints.

The pandemic forced companies to adopt a more technologically advanced approach to managing customer service. Increasingly, BPO providers have turned to customer experience solutions to improve client-customer interactions, further enhancing value-added capabilities. The gradual shift to cloud-based, AI-drive operations and away from legacy on-site hardware systems has charted new opportunity paths in the space.

Macroeconomic Effects

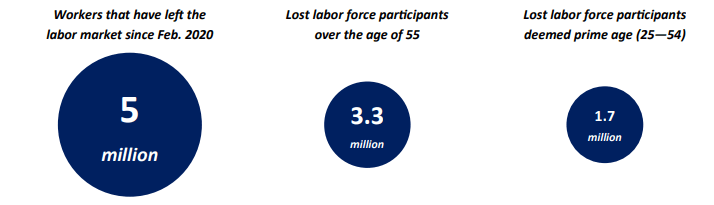

During a time of unprecedented labor shortages, BPO solutions have never been more critical to client success. According to Barron’s, roughly 5 million individuals have left the labor market since February 2020. The national Federation of Independent Businesses (NFIB) cited a lack of workers for unfilled positions, along with supply shortages, as the biggest problems in its October survey. This is forcing small businesses to boost compensation to the highest level since 1984 (Barron’s).

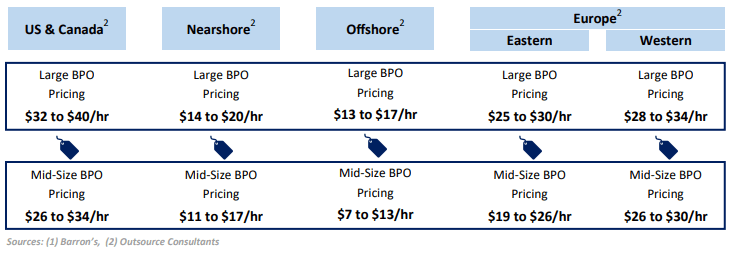

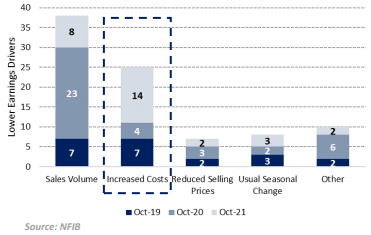

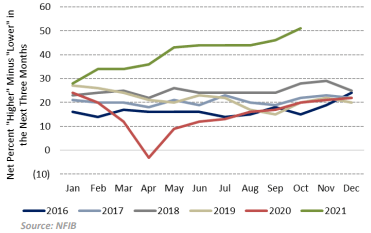

A recent survey asked business owner participants if profitability during the last calendar quarter was higher or lower and what the most important reason was influencing deviation (below left). Additionally, the survey assessed expectations over the next three months regarding planned selling price changes or goods and/or services (below right). With increased operating and non-operating costs on the rise, including labor, materials, financing costs, taxes and regular costs, BPO services provide businesses with viable solutions to the labor market’s current inefficiencies. Moreover, as businesses continue to face labor pressures and supply chain constraints, BPO services allow clients to focus on delivering creative solutions for their customers, such as alternative coursing, distribution methods, and product and service mix.

Profitability Headwinds

October 2021

Planned Selling Price Changes

Seasonally Adjusted

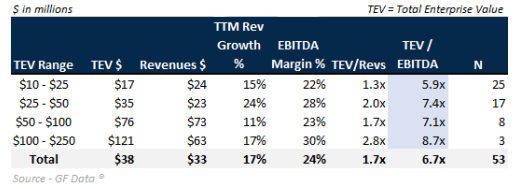

Private Equity Multiples: Business Support Services

(2012-Present)

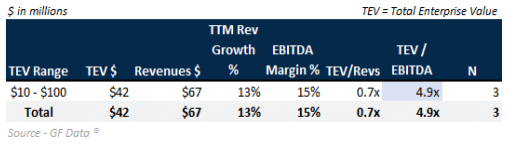

Private Equity Multiples: Telemarketing Bureaus & Other Contact Centers

(2012-Present)

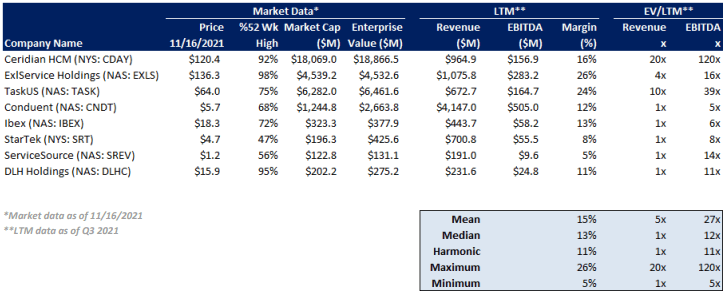

Public Company Trading Data

Business Process Outsourcing (BPO)

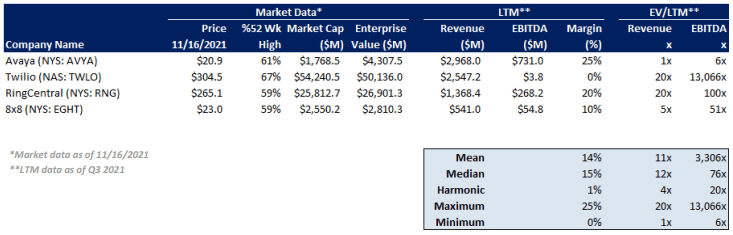

Contact Centers—Exclusively Voice and Communication Technology Services

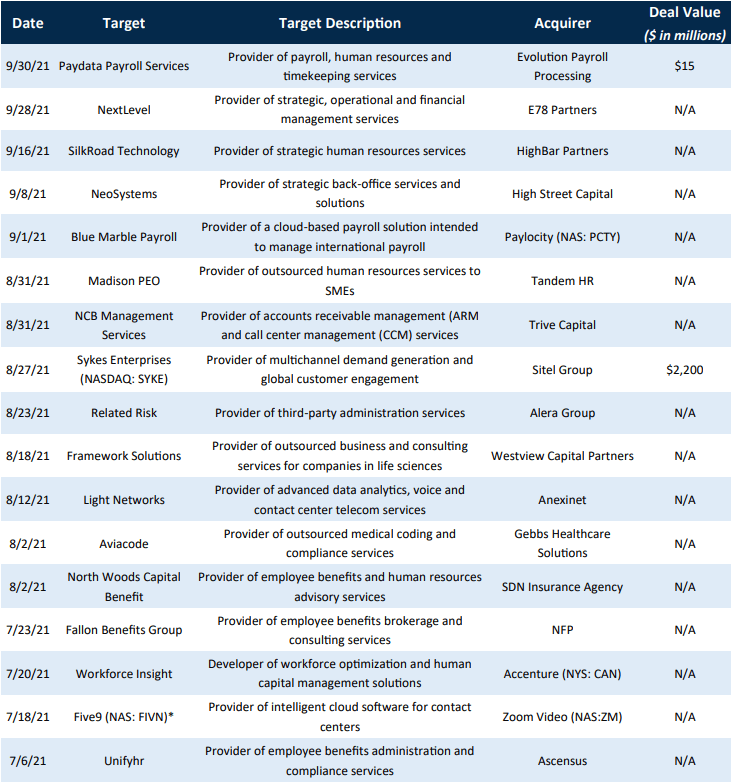

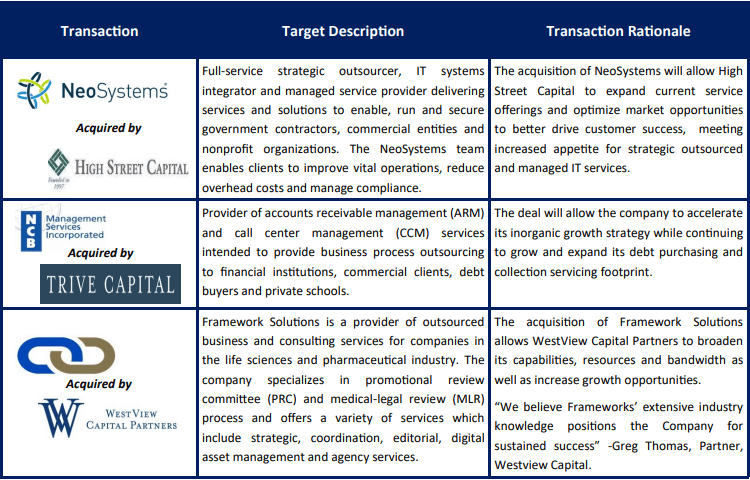

Select M&A Transactions