Evolving Value-Added Capabilities

In Carleton McKenna & Co’s BPO & Contact Centers M&A Activity report, our Team explores the ever-evolving business process outsourcing (BPO) environment. Decisions to outsource services, such as payroll and customer support were historically driven by cost reduction strategies, as these services were predominantly offshored to less developed nations with low-wage workers. Fast forward 20 years to the current business environment, and BPO services are delivering value-added capabilities such as robotic process automation (RPA), descriptive analytics and reporting to multiple organizational functions (e.g., Customer Service, Finance, Human Resources, Information Technology, and Legal, among others). As business process outsourcing companies position themselves as a partner in client success, multifunctional support is becoming the standard.

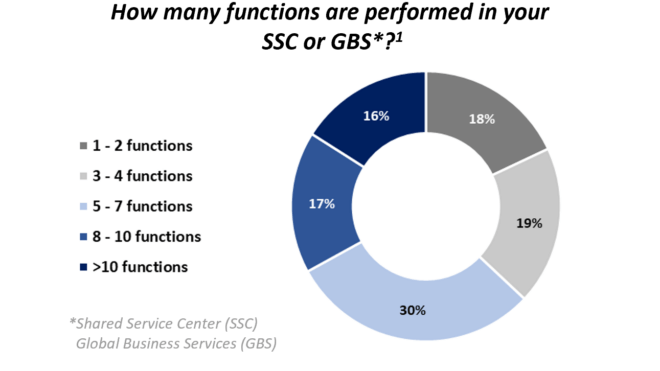

According to a recent survey conducted by Deloitte, nearly 82% of BPO respondents support more than three organizational functions. Outsourcing has transformed from pure back-office work transfer, to a technological change agent guiding progressive organizations into the future of work. As such, cost reduction motivations have taken a back seat to (i) seamless process implementation, and (ii) organizational standardization across geographies.

Adoption of New Technologies

Robotic process automation (RPA) is the leading technology adopted and implemented by business process outsourcing firms to handle rules-based (e.g., if this then do this) task handling. More advanced organizations are also turning to artificial intelligence capable of natural language processing to deliver faster, more accurate solutions.

RPA bots are driving agility in (i) contact center automation, (ii) back-office processes, and (iii) front-office augmentation (Automation Anywhere). For example, automation allows contact center agent to prioritize attention on customer interaction while bots handle data processing.

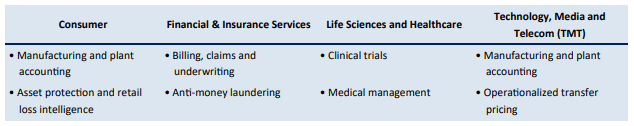

Examples of specialized capabilities across different industries

Integrated Business Model

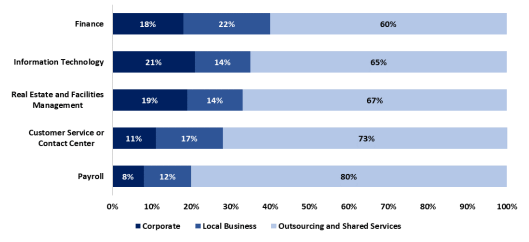

BPO firms deliver significant value to end-market clients, especially as the breadth of employed outsourced services crosses organizational functions. Outsourcing scope has proliferated from a few traditional functions, such as Finance, IT and insurance third party administrators (TPAs). Recent trends to layer “non-core”, but essential, supporting services has led to a deepening of integrated outsourced services within organizations. Interestingly, organizations are encouraging BPO partners to innovate on behalf on the organization which, in turn, drives overall business value.

To incentivize BPO-driven innovation, organizations are aligning mutual interests in one or a combination of the following: (i) rewarding BPOs with additional services, (ii) explicitly outlining innovation clauses in the contract, and (iii) increasing compensation as innovation is demonstrated (NextTarget).

What percentages of FTEs (approx.) are located in the local business, at corporate, or in an outsourcing and shared services model?

Standardization of Process Efficiencies

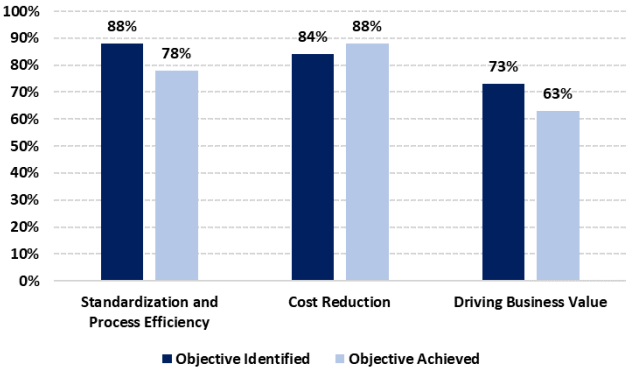

Standardization of process efficiencies has been reported as the No. 1 strategic objective in 2021, largely fueled by the pandemic’s “winners” demonstrating an ability to quickly respond to changes in respective markets. As businesses increasingly expand beyond domestic borders, process efficiency standardization is critical for organizations to gain market share.

Objectives of Investing in GBS and SSC Capabilities, and Progress Toward Defined Objectives

Contact Centers

When brick-and-mortar retail shuttered during the pandemic, contact centers emerged on the frontline to service customer experiences. In fact, during a four-month period in 2020, contact center volumes rose as much as 20% (RingCentral). Such volume pressures have accelerated contact center migration from location-bound roles and services to the cloud, resulting in greater flexibility and process efficiencies. Additionally, cloud migration has alleviated significant fixed costs and overhead required to service on-premise server hosting (NextTarget).

Cloud migration has allowed contact center agents to process high volume customer inbound requests irrespective of location. Remote work permits flexibility and leads to lower turnover among contact center agents; a shift from high headcount turnover which has been an industry norm.

Investor Attraction

Businesses are turning to international markets to tap future growth, driven in part by slowing domestic growth, while looking to reduce corporate footprints as the work-from-home lifestyle carries forward in hybrid applications. These trends are tailwinds for BPO and contact center firms as organizations look to outsource non-core business processes for efficiency. Buyers have demonstrated particular interest in these companies with: (i) successful implementation of new technologies at scale; (ii) sticky, recurring revenue models; and (iii) capex-light business models.

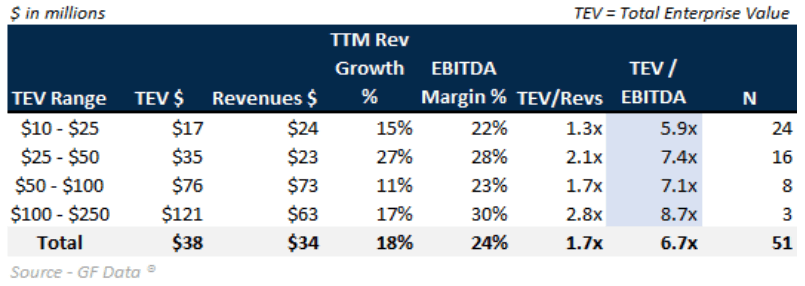

2012 to Present Private Equity Multiples—Business Support Services

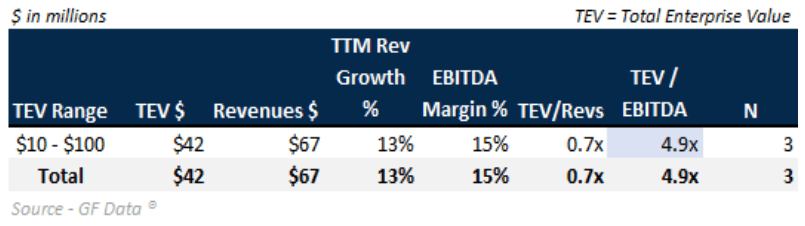

2012 to Present Private Equity Multiples—Telemarketing Bureaus & Other Contact Centers

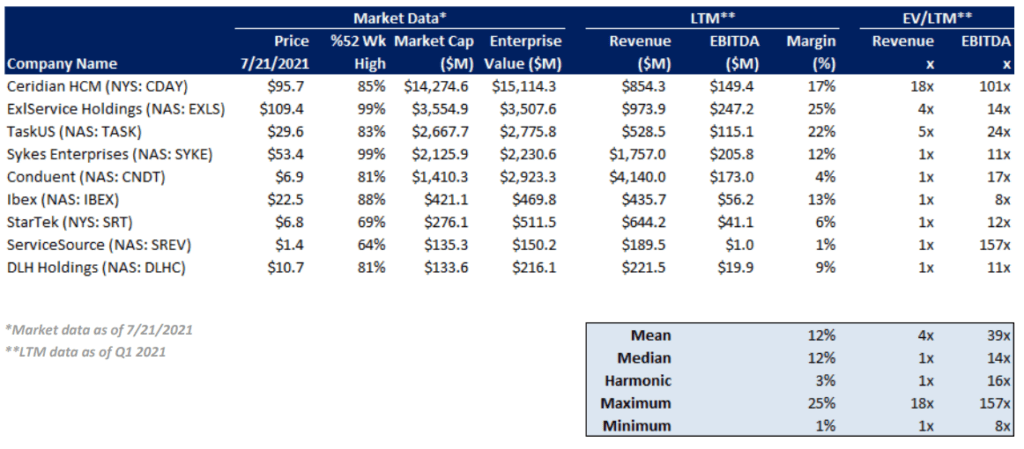

Public Company Trading Data

Business Process Outsourcing (BPO)

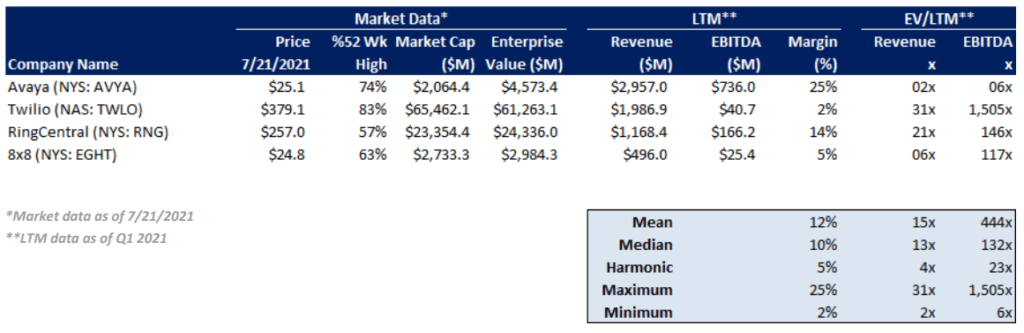

Contact Centers — Exclusively Voice and Communication Technology Services

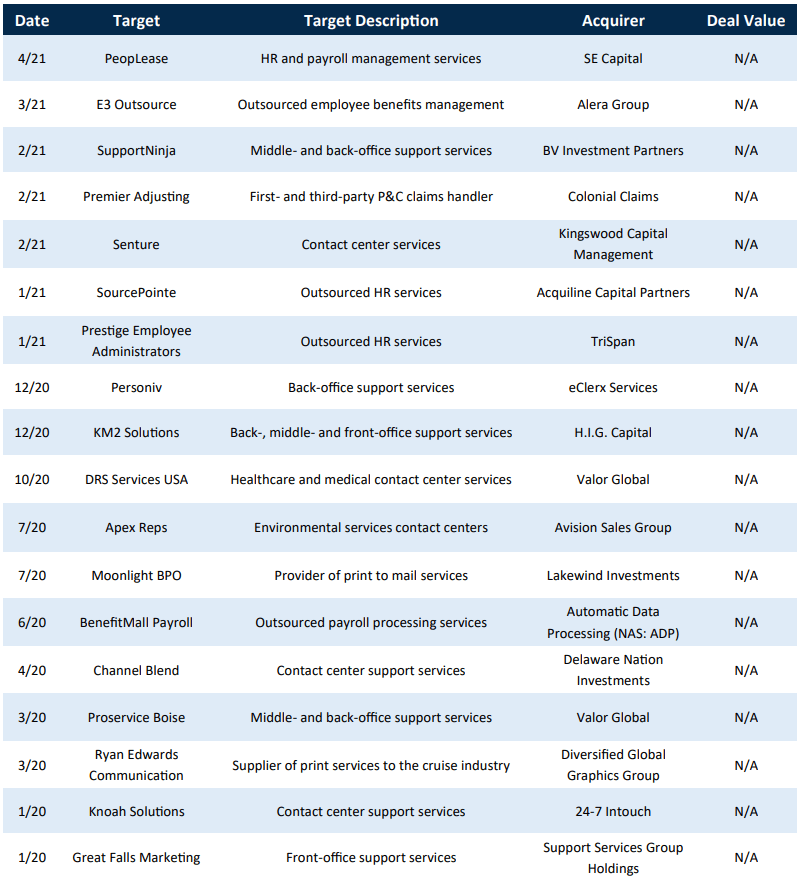

Select M&A Transactions