BPO firms have been riding the coattails of the healthcare economy in part due to the rising number of seniors needing greater medical assistance and support. Many healthcare businesses elected to outsource operating costs associated with patient care, allowing the BPO market to continue growing at a CAGR of 1.9% to $72.1 billion¹.

Industry trends continuing to influence BPO market growth include (i) rising wage costs cutting industry profits for BPOs and BPO clients, (ii) reliance on non-core, IT-related business solutions and (iii) increased compliance restraints and guidelines for more technologically advanced clients.

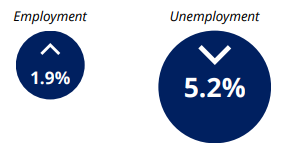

US Labor Force Participation Rate Variance YoY*²

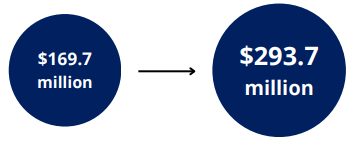

Projected BPO Market Value Growth from 2021 to 2029³

Call Center Activity Amid Economic Variance

Given the high volumes of technological growth expanding across the BPO and Call Centers markets, economic uncertainty is the leading factor for profit and revenue instability. To remain ahead of the declining market, BPOs should look to increase client recruitment efforts within prosperous industries as forecasted recurring revenue could generate greater corporate profit and mitigate the widening gap between operating costs and revenue.

Similarly, demand from booming industries will remain a key external driving factor in supporting the growth and expansion of BPOs and contact centers. Finance, banking and insurance companies constitute the most significant demand for BPO services¹. Companies in these industries are responsible for large amounts of sensitive client, and proprietary data, so prospective BPO clients are choosing to outsourcing time consuming and data driven tasks to BPOs with greater technological integrations, therefore supporting BPO industry revenue. However, compliance and confidential information restraints will hinder BPOs that have yet to onboard greater internal IT-related security. Companies operating in the Professional, Scientific and Technical Services sectors will also continue to source labor and other administrative functions in ways that will continue to benefit the BPO industry. Should BPOs not serve clients within these growing sectors, the overall market decline is forecasted to pose a threat to the health of those BPOs operating on narrower margins.

Economic Impact into the Future

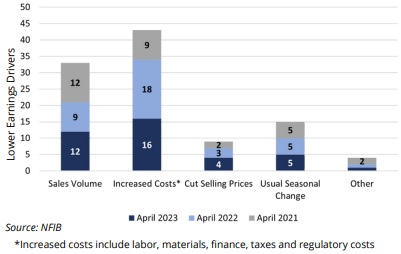

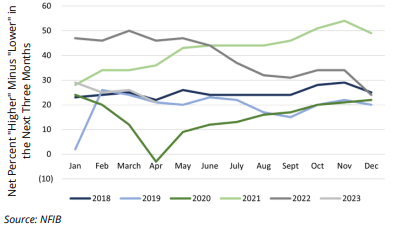

A recent survey from the National federation of Independent Businesses (NFIB), asked business owner participants if profitability during the last calendar quarter was higher or lower and what the most important factor was influencing the deviation. Additionally, the survey assessed business performance expectations over the next three months based on planned selling price changes of goods and services (NFIB).

According to the NFIB’s April 2023 Report, the Small Business Optimism Index still sits below the average at 89.5. As of May 2023, this is the sixteenth consecutive month where the index sits below the 98.0 average.

Curbing Tailwinds

Business Process Outsourcing

Rising wage costs have mitigated the slow growth brought on by the pandemic in 2020. Though the rebound toward industry prosperity has been slow, the associated cost savings for potential BPO clients has led to a surge in industry activity.

According to the Bureau of Labor Statistics, benefits, including health benefits, accounts for an estimated 29.2% of employer costs².

Cost savings and health benefits are the primary benefits of using BPO services and therefore, are appetizing to smaller businesses that can’t sustain inflation-led wages in the long-term. However, the inflationary wage hikes haven’t benefitted BPO companies in the interim. Many businesses have dealt with a cut to profits in recent years. Lower corporate profit has hindered the growth of BPO companies since clients are less willing to agree to large contracts for extended periods.

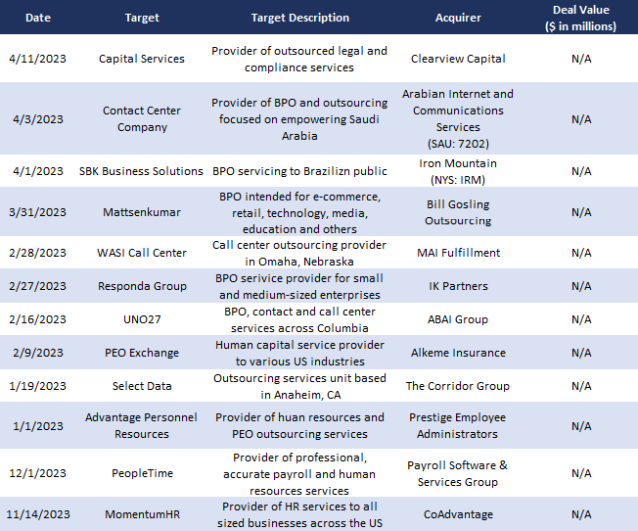

Transaction Rationale⁴

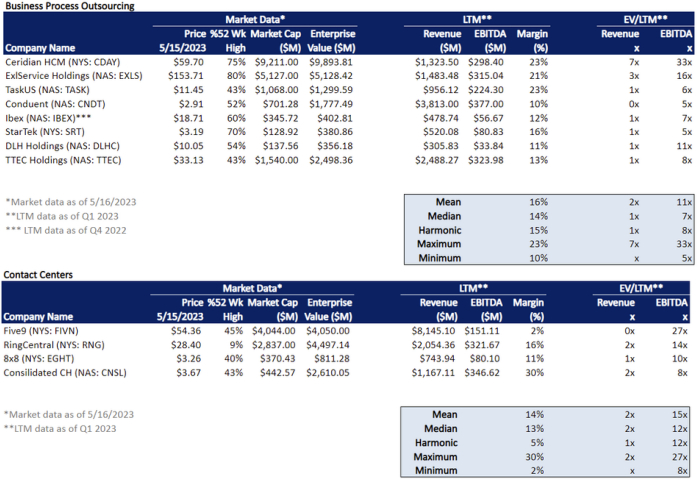

Public Company Trading Information

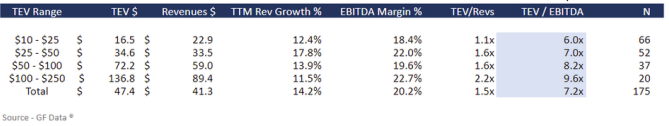

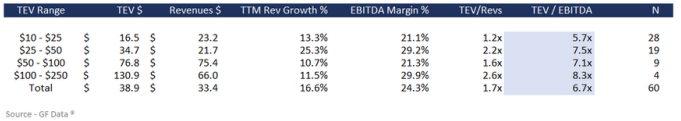

Private Equity Multiples: Business Support Services

(2012-Present)

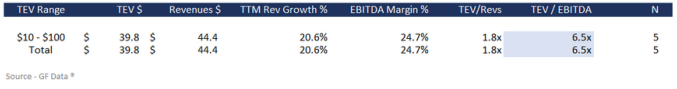

Private Equity Multiples: Telemarketing Bureaus & Other Contact Centers

(2012-Present)

Private Equity Multiples: Telemarketing Bureaus & Other Contact Centers

(2012-Present)