The installation of heating and air conditioning (HVAC) units relies heavily on trends within the broader construction industry, whether that be through commercial, industrial or residential subsectors. However, the repair and maintenance of HVAC units offers a more steady stream of industry revenue regardless of demand for new construction.

Market-specific dynamics also influence demand for many services provided within the industry, but more recently, residential construction boomed with record low-interest rates and exponential government aid — causing demand for HVAC units to spike.

Nonresidential construction struggled during the pandemic and inflated interest rates from the Fed have resulted in steady market decline for new construction and repair for nonresidential and residential markets — severely threatening industry prosperity.

HVAC businesses will face challenges in the near future due to higher interest rates, but steady economic growth will contribute to a revived nonresidential market. Additionally, the residential market is forecast to rebound steadily from the pandemic decline as homeowners look to install new systems that help prevent the spread of viruses and cut down on carbon emissions.¹

Key Success Factors¹

Revenue for heating and air-conditioning services has increased at a CAGR of 0.4% to $123.2 billion in 2023, through rates will not remain that high. Before the year is over, revenue is forecast to decline 5.8%. Key industry factors will dictate the efficiency and proficiency of sustaining long-term revenue streams in a declining market.

Heating and air-conditioning will remain a necessity during recessions or expansions. HVAC businesses with strong customer retention rates will continue to sustain revenue and avoid large negative disruptions.

Government aid and higher interest rates have significantly impacted the purchase rate of new nonresidential and residential spaces. HVAC businesses that were one eligible for PPP loans are now garnering demand from nonresidential building owners partaking in QIP tax write-offs.

COVID disruptions to some markets have left consumers spending less. Not only was HVAC installation, maintenance and repair declining, but the purchase of many non-essential household appliances diminished revenues entering the subsector.

Together, the HVAC systems and services markets are projected to reach $230 bullion in the United States by 2023 (growing at a CAGR of 5.0% — up from $207 billion in 2021), and with that growth, sufficient consolidation is the be expected.² The demand for companies with energy-efficient solutions from both residential and commercial users will benefit VRF systems businesses and those with a focus on Internet of Things in HVAC; these technologies can offer a more cost-effective installation with greater flexibility — a higher price point and appeal to environmental conscious consumers.²

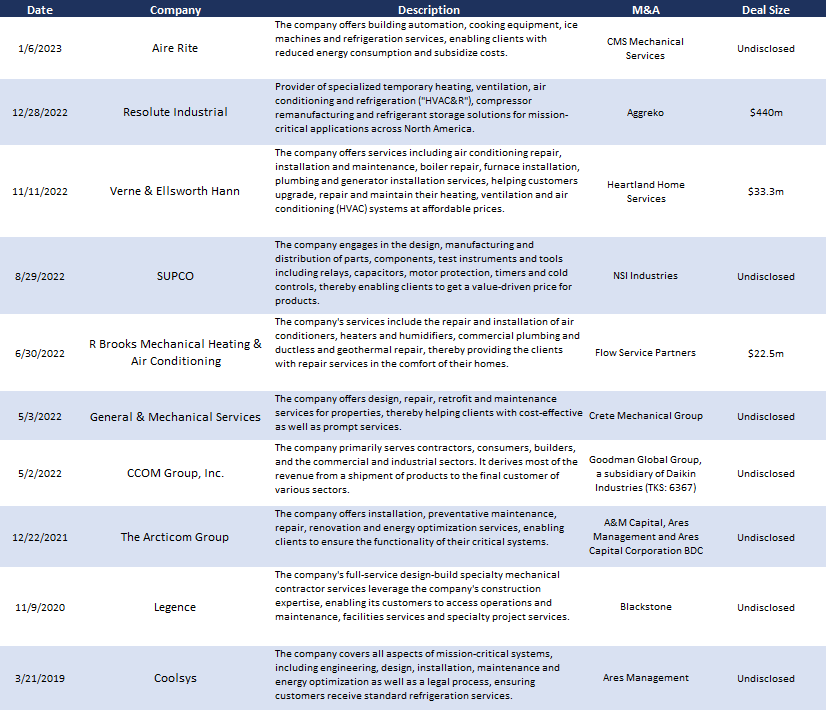

Like many historically fragmented industries, HVAC services and related maintenance, systems and installation providers have seen a persistent uptick in M&A activity stemming from 2021. Both Financial and Strategic investors are particularly interested in acquiring businesses with consistent revenue, rather than those that may be ties to new construction.³ Additionally, there is an increasing appetite to couple services businesses that share end markets (i.e., Legacy Service Partners partnership with John Henry’s Plumbing, Heating & Air.)³

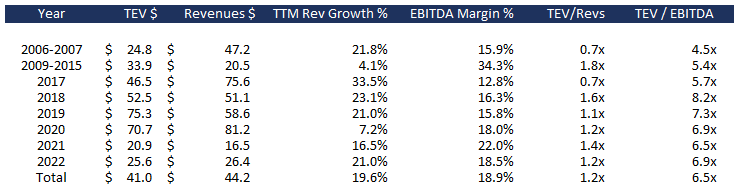

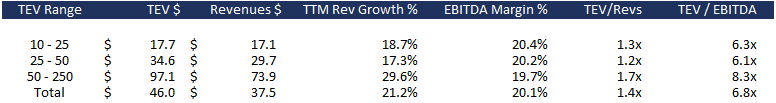

Plumbing Air-Conditioning and Heating Industry Multiples⁴

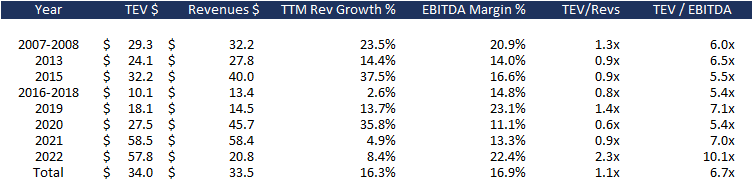

Commercial & Industrial Machinery and Equipment Repair and Maintenance Industry Multiples⁴

Ventilation, Heating, Air-Conditioning and Commercial Refrigeration Manufacturing Industry Multiples⁴

HVAC M&A Activity⁵

CM&Co Case Study

CM&Co acted as the exclusive financial advisor to Service-Tech Corporation (“STC”) in the Company’s sale to Pittsburgh, Pennsylvania-based GT Entrepreneurs (“GTE”). Founded in 1960, STC specializes in complete heating ventilation and air-conditioning (HVAC) cleaning and industrial cleaning. The STC team serves a variety of industries and facilities throughout the region, with its corporate headquarters in Cleveland and a regional office in Columbus. GTE is a private investment firm that works with entrepreneurial Operators -in-Residence looking to individually acquire, operate, and grow privately-held businesses. In the purchase of STC, GTE’s Operator-in-Residence moved to Cleveland and assumed the role of President with support of the previous owner for the short-term. GTA hired all existing employees, planning to provide the same services and products to customers. The acquisition price was not disclosed.