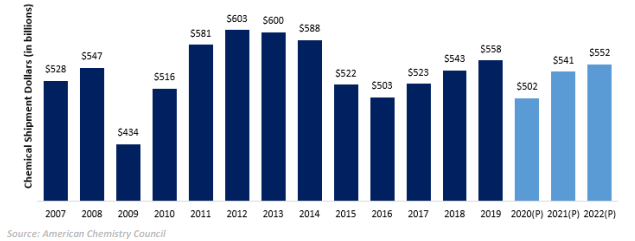

The chemicals industry was significantly impacted by two unprecedented and monumental events over the past few months: (i) the onset of the COVID-19 pandemic, and (ii) an ongoing price war that has caused a significant decline in the price of oil. During the first half of 2020, most chemical companies experienced decreased demand for their products, as end-use markets such as auto, construction, consumer staples, pharmaceuticals and nutraceuticals were, and continue to be, heavily impacted by COVID-19 shutdowns. The ongoing price war in the oil market creates additional headwinds, as falling oil prices could lead to steep price cuts for chemical companies when faced with lower demand in a down economy.

Companies that are able to emerge in a relatively strong position will likely turn to M&A to either gain market share or invest in new technologies or formulations to serve niche high-margin applications.

Chemical Shipment Spending—Historical and Projected

Post-Crisis Strategy Insights For Chemicals Companies

Manufacturing Automation

When possible, adoption of cloud data and automation will optimize manufacturing processes to create significant long-term savings.

Re-examine Workforce Management

Rethink internal operations and the optimal ways to organize your workforce. As non-production roles are increasingly conducted remotely, look for ways to reduce costs in areas such as real estate.

Invest in Competitive Advantages

Invest in technolog and/or proprietary formulations to further scale or advance your competitive advantages. Focus on creating products that allow for higher prices by providing niche and differentiated solutions.

Support Customers and Suppliers

Look for opportunities to further connect customers on both the buy-side and pricing-side and help customers and suppliers withstand this volatile period.

Aggressively Cut Costs

Improve your cost structure to further insulate your company from further demand uncertainty. These efforts include: finding alternative sources for cheaper inputs, automating processes where possible, and rethinking certain aspects of doing business, such as travel budgets.

Improve Resiliency of Supply Chains

The current economic and geoppolitical environment has highlighted the importance of a diversified supply chain. In addition to creating competitive dynamics that can help to lower input costs, diversification of suppliers can reduce the risks caused by apandemic, trade war, or other unforeseen disruption to supply chains.

Source: William Blair Research

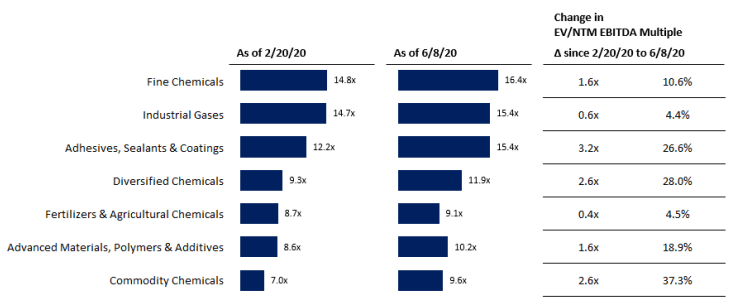

Benchmark Valuation Impact on Chemical Indices (EV/NTM EBITDA)

Source: Capital IQ

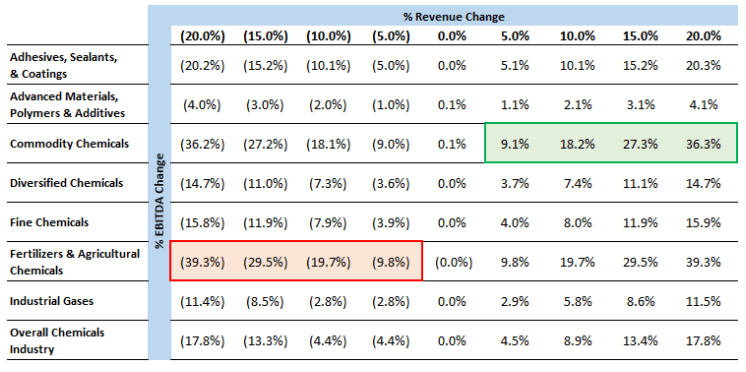

Impact of Revenue Change on EBITDA in the Chemical Industry—by Sector

Source: Capital IQ & S&P 500

The illustration model (above) shows historical correlations between revenue and EBITDA for various segments of the chemicals industry from 2006 through Q1 2020. Lower value-add segments such as commodity chemicals and fertilizers & agricultural chemicals have significantly greater EBITDA sensitivity to revenue changes than other segments.

Select Carleton McKenna & Co Specialty Chemicals Transactions