COVID-19 Spurs Increase in Self-Care

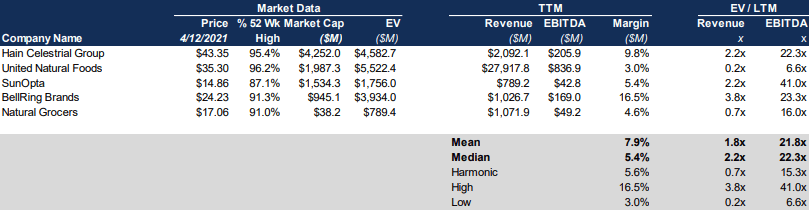

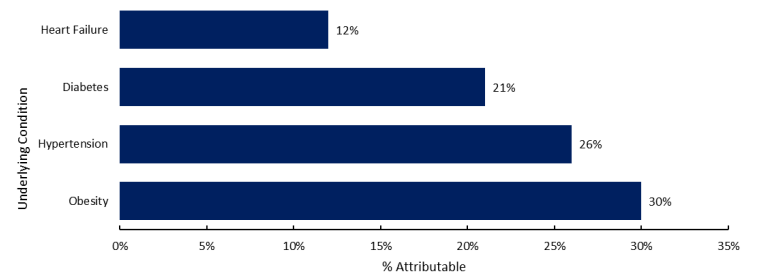

Out of the 907,000+ COVID-19 hospitalizations in the United States, the following underlying conditions constituted the majority of COVID-19-related hospitalizations: obesity (30%), high blood pressure (26%), diabetes (21%) and heart failure (12%) (Journal of the American Heart Association).

As more than half of the U.S. population has an underlying condition, widespread COVID-19 cases have sparked preventative self-care initiatives among all demographic segments, albeit to a varying degree. It is no question those with underlying conditions are most at-risk if the virus is contracted, but even the population not ‘at-risk’ is taking preventative lifestyle measures in hopes of increased immunity.

COVID-19 Hospitalizations Attributable to Underlying Condition

Self-Care Initiatives

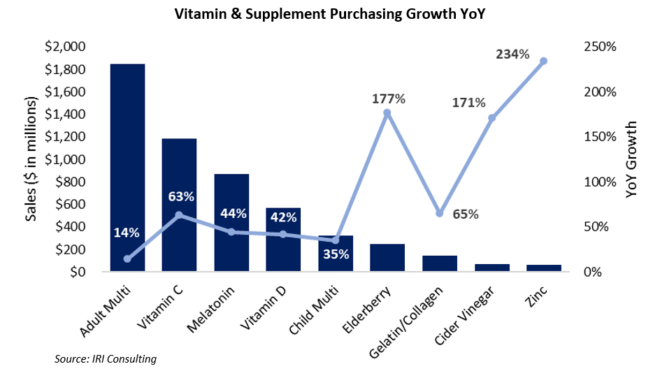

During a period with many unknowns, Americans have taken it upon themselves to prioritize personal wellbeing. Specifically, in an environment lacking viable pharmaceutical vaccination for the better part of a year, Americans turned to vitamins, minerals and supplements (VMS) as an alternative to boost immunity and/or limit symptoms of the coronavirus. Zinc, Elderberry, and Cider Vinegar have experienced triple-digit growth YoY as they contain immunity boosting antioxidants and vitamins (IRI Consulting).

- 34% of Gen Z/younger millennials incorporate VMS products in their daily routine to boost immune response, compared to only 11% of baby boomers (IRI Consulting).

- VMS products witnessed an uptick in sales growth in Q1 2021, similar to that experienced in Q1 2020 when COVID-effected consumer purchasing activity emerged for the first time.

Vitamin & Supplement Purchasing Growth YoY

Self-care is not a cut and dry concept. It could mean incorporating VMS products into one’s daily routine, more frequent/more deliberate handwashing, or even implementing a regular workout regiment complemented by a plant-based diet. In any case, the goal is to promote overall wellbeing.

Preventative Lifestyle Measures

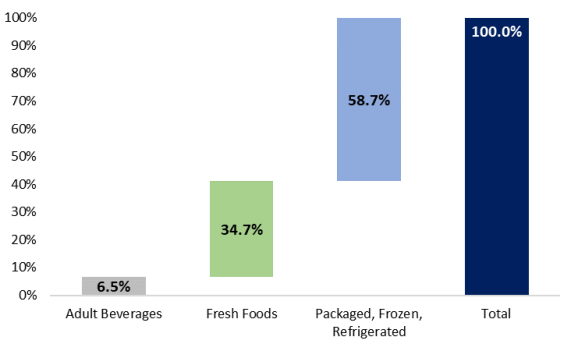

As immunity and overall wellbeing become top of mind, attention to the quality of food products consumer has heightened. Noteworthy, 60% of American have chronic underlying conditions associated with COVID-19 risk, while 40% of Americans have two or more (CDC). As the pandemic has led to an increase in consumer preference for home-cooked meals (vs. dining out), Americans are (i) allocating more time to meal preparations, (ii) paying closer attention to food labels, and (iii) aligning shopping lists with health as a primary purchasing driver. Compared to the same period a year ago, the grocery department dollar % growth is as follows:

- Fresh Foods (+10.5%); and

- Packaged, Frozen Refrigerated (+13.6%).

The Food and Beverage industry’s better-for-you segment has resonated favorably among younger consumers. Gen Z and millennials in particular are strong subscribers to preventative measures (e.g., exercise and better-for-you foods and beverages, among others), while baby boomers are more likely to turn to traditional medical care and prescription remedies.

Grocery Department Dollar Share

Alternative Revenue Channels

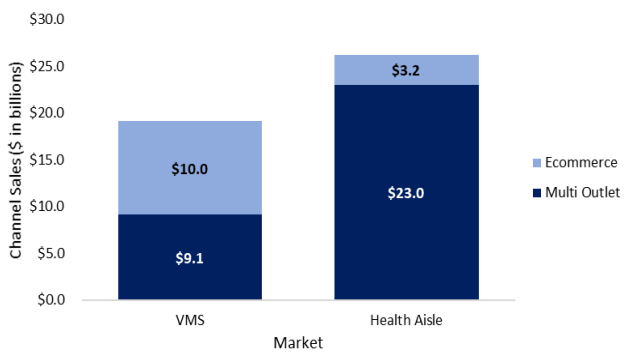

The channels in which consumers interact with health and wellness-focused brands and products are diverse across the industry (see revenue Channel chart). For example, VMS sales are near evenly split among ecommerce and multi-outlet, while Health Aisle* sales are heavily reliant on multi-outlet accessibility. Noteworthy, Health Aisle sales have increased nearly 100% while VMS sales are up 46% compared to 2019 (IRI Consulting).

Health Aisle captures non-VMS health-related products including, but not limited to, plant-based ingredients, low-glycemic and unsweetened foods, microbiome (gut) health and nutrient-dense foods.

Revenue Channels

Grocery foods have also benefitted from e-commerce channel migration tailwinds:

- When surveyed by IRI Consulting, nearly 1 in 5 (17%) of households identified online shopping as the preferred method.

- Fresh foods in particular represented $4B in e-commerce sales during the second half of 2020 (+99% YoY).

Trust & Brand Recognition

As retail locations shuttered for much of 2020, consumers turned to brands they could trust across digital channels. This countered a pre-pandemic, decade-long trend where niche and private-label products grabbed market share from branded items. However, safety and security factors have become increasingly critical in consumers’ decision-making processes, which has lead to a sales resurgence in trusted name brands in recent months.

For example, Deloitte conducted a study during the pandemic to observe the relationship between brand trust and concern for both physical and financial wellbeing. Physical and financial wellbeing concerns explained 85% of the movement in consumers’ propensity to purchase name brands they have come to trust (Deloitte).

Leading Vitamin, Mineral and Supplement Brands

Investor Attraction

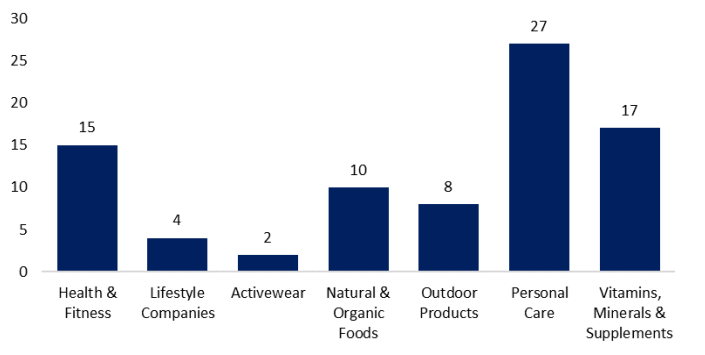

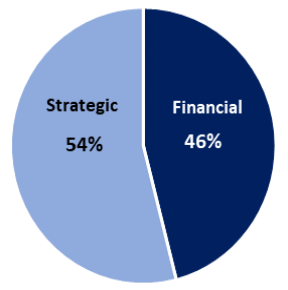

Companies operating in health and wellness have drawn interest from both strategic and financial buyers. Strategic buyers slightly outpaced private equity in the second half of 2020 constituting 54% of total transactions across health and wellness segments. Within the health and wellness space, private equity was particularly active in the VMS category in 2020, representing 21% of total deal volume. Buyers have demonstrated particular interest in companies with:

- Strong brand recognition;

- Recurring revenue; and

- Digitally native DTC competencies (NBJ).

Transactions by Health and Wellness Segment

Transaction by Type

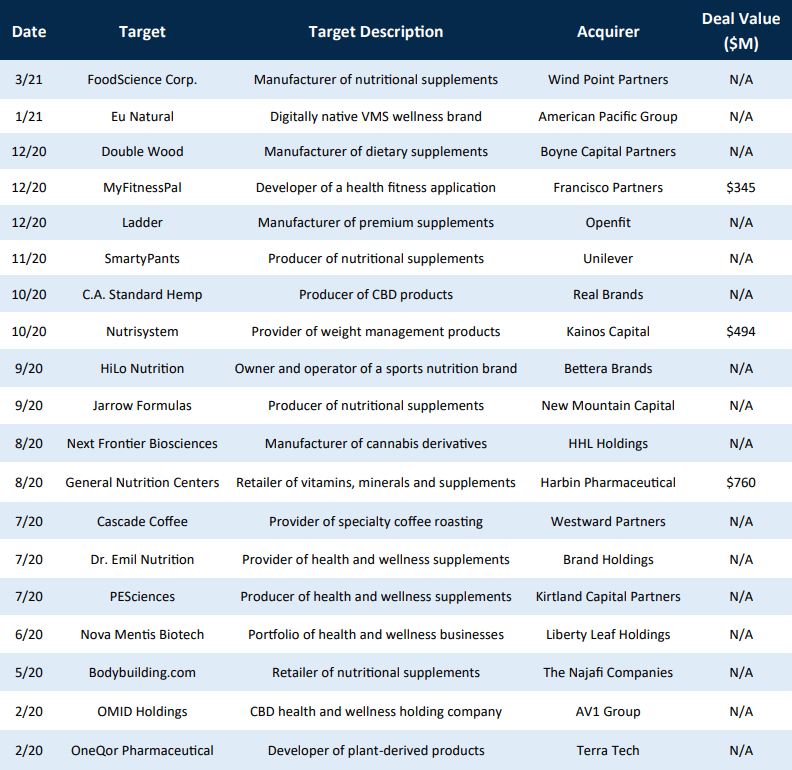

Select M&A Transaction (LTM through March 2021)

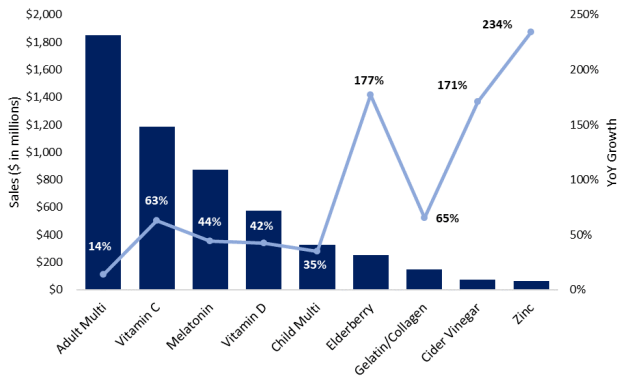

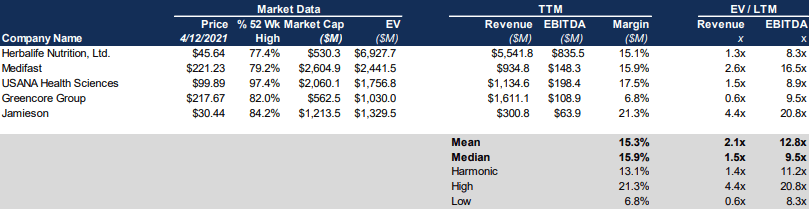

Public Company Trading Data

Vitamins, Minerals and Supplements (VMS)*

Natural Foods*