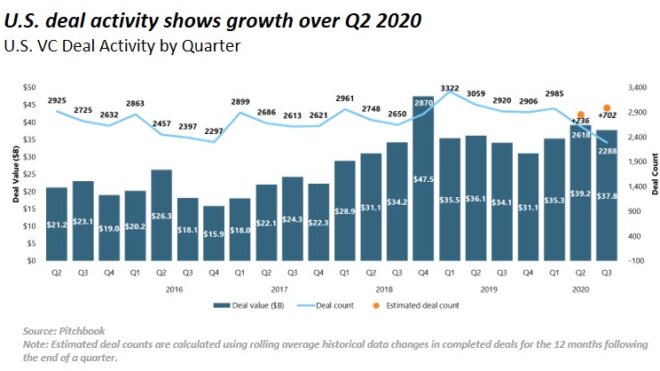

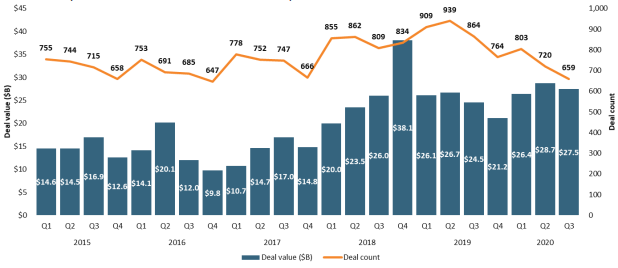

Despite the persisting COVID-19 pandemic, stay-at-home circumstances and continued economic volatility across the country, the growth capital market ecosystem has been rather resilient in 2020. Most institutional investors have adapted to new, remote ways of doing business, and capital invested continued at a strong pace in the third quarter. The $37.8 billion invested in Q3 was actually slightly above Q3 2019, largely due to later-stage investments. Deal volume also held steady, with an estimated 2,990 completed deals in the quarter (includes deal count estimations for lags in reported and announced deals—see orange markers on chart above).

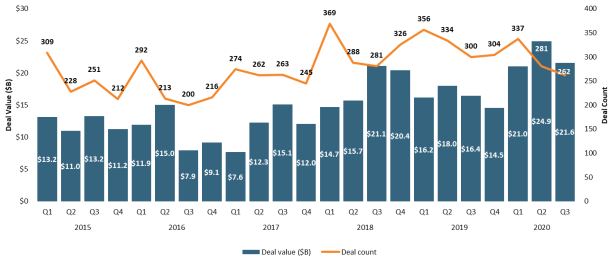

Signs of recovery in early-stage Q3 deal activity

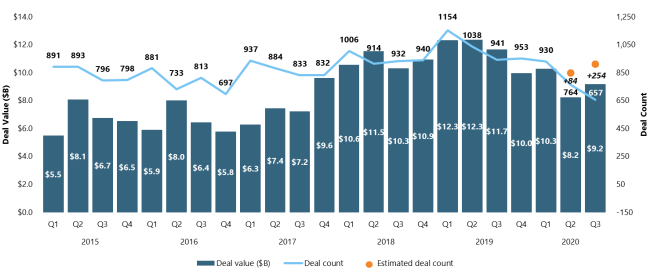

U.S. VC Early-stage Deal Activity by Quarter

Early-stage deal activity showed signs of rebounding in Q3 2020, with a total of $9.2 billion invested across an estimated 911 deals during the quarter. After a lagging Q2, early-stage investors appear to be more comfortable investing in companies navigating a “new normal.” Further, larger check sizes continue to dominate the early-stage in Q3, with checks over $25 million making up 15.4% of early-stage deals YTD (through September 30) and 18.2% in Q3 alone.

Further resilience demonstrated by late-stage deal activity during pandemic

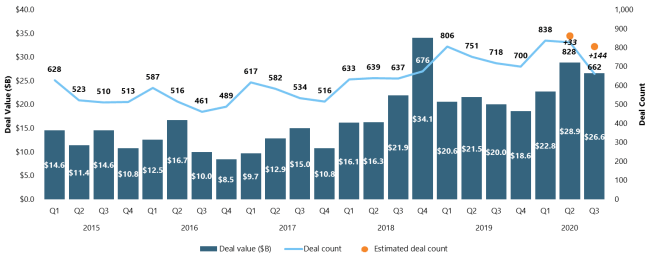

U.S. Late-Stage Deal Activity by Quarter

Later-stage growth capital deal activity has also demonstrated resilience during the pandemic. In Q3 2020, there were an estimated 806 deals closed during the quarter across $26.6 billion in invested capital, bringing the YTD total to $78.2 billion. As investor uncertainty prevails, late-stage companies are viewed more attractively because they represent a lower risk relative to their early-stage counterparts.

Larger deals are gaining influence

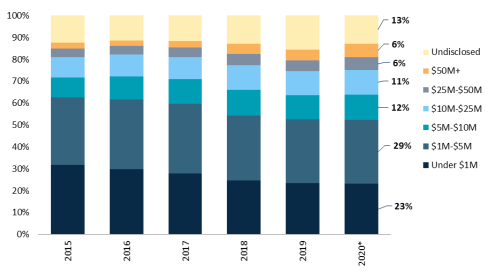

% of U.S VC Deals by Size

Deals $5M+ made up ~40% of total disclosed VC deals during the first 9 months of 2020.

*Through September 30, 2020

Further resilience demonstrated by late-stage deal activity during pandemic

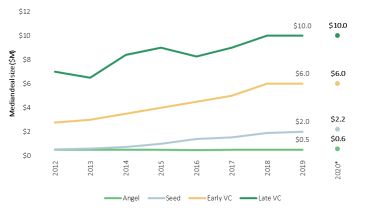

U.S. VC Median Deal Size by Stage

Median valuations continue to grow

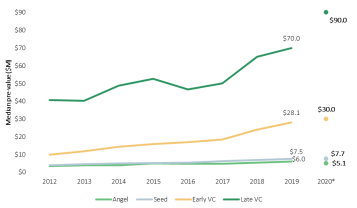

U.S. VC Median Pre-Money Valuation by Stage

The move toward larger deals has been in motion for the past five years. However, the advent of the pandemic further accelerated this trend, as uncertainty and a desire to support stronger portfolio companies is likely driving a “flight-to-quality” and an investor preference for later stage opportunities.

In tandem with deal sizes, valuations continue to rise relative to 2019, particularly in latter-stage. This increase can be largely attributed to (i) the growing population of startups choosing to raise capital in 2020, and (ii) a record number of VC mega-deals with a larger proportion of capital going to deals over $25 million. This valuation growth further demonstrates that investors are backing the most mature and least risky businesses, given the current economic uncertainty.

Modest slowdown from pandemic for nontraditional investors

U.S. VC Deal Activity with Nontraditional Investor Participation

Nontraditional investors (CVC arms, direct equity investments by corporations, hedge funds, mutual funds, etc.) continue to play an integral tole across capital markets. Through the YTD period, nontraditional investors contributed to 82% of U.S. venture deal value. With growth coming at a premium in public markets, many nontraditional investors have shifted strategies toward the private market, where there are more opportunities to invest in hyper-growth companies.

Rising deal values in U.S. growth equity; Number of deals moderates

U.S Private Equity Growth Capital Activity by Quarter

While overall U.S. private equity deal activity has lagged in the wake of the COVID-19 pandemic, technology-focused and healthcare-related buyouts and growth equity deals have kept relatively steady (data included in the chart above reflects growth equity activity for companies identified as private equity). Further, valuations have remained stable through the pandemic, even rising in some cases. The current trend of weaker deal activity across other sectors appears poised to change in the coming quarters as more announced deals will likely lead to a pick-up in future deal-making. Credit markets are rebounding and will keep liquidity flowing to fund new buyouts and dividend recaps (See Carleton McKenna’s Leveraged Finance Report September 2020).